Let’s discuss the question: where can you open a coverdell education savings account apex. We summarize all relevant answers in section Q&A of website Countrymusicstop.com in category: MMO. See more related questions in the comments below.

Table of Contents

How do I open a Coverdell account?

Where Can You Open a Coverdell Education Savings Account? You can open the ESA at a financial institution of your choosing. If a bank or investment institution offers IRAs, it will usually also offer ESAs. Many charge an annual maintenance fee, and some may require a minimum annual contribution.

Who can contribute to a Coverdell Education Savings Account?

Who Can Contribute To A Coverdell? Any adult—parents, grandparents, aunts and uncles, or friends—may contribute to a child’s Coverdell account as long as his or her income falls within the guidelines. However, the total contribution from all sources cannot exceed $2,000 annually per beneficiary.

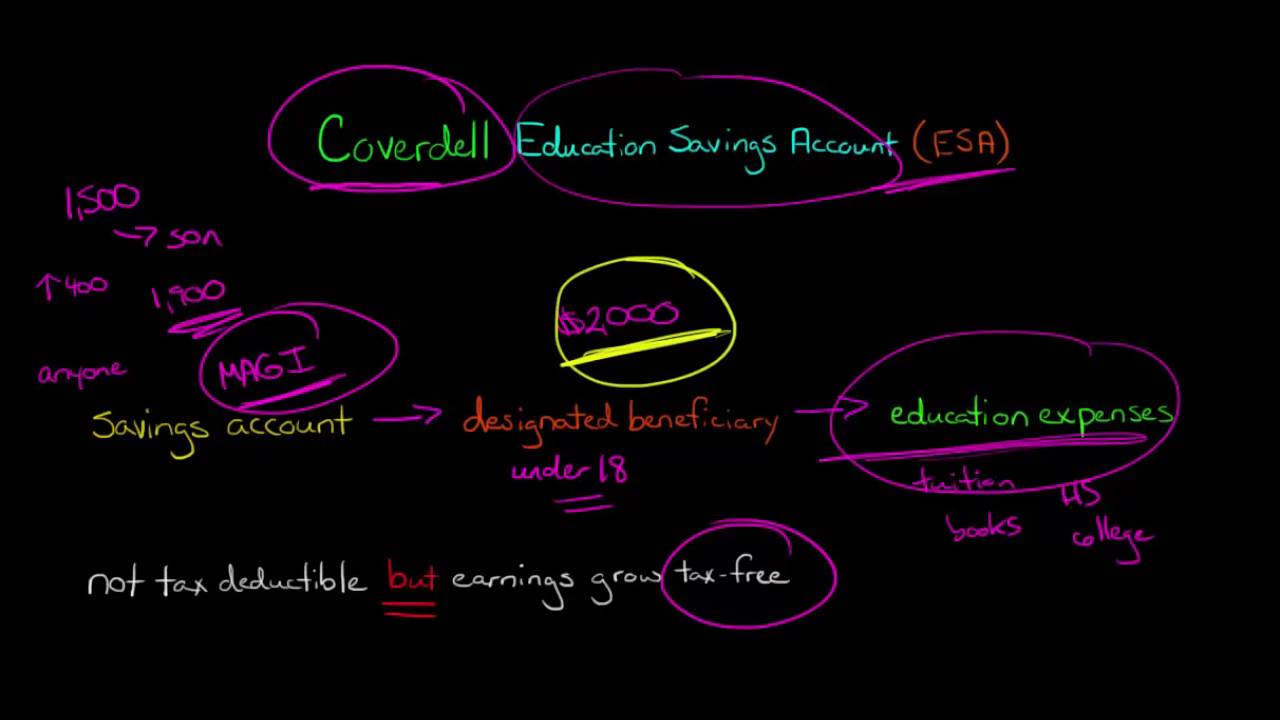

Opening Up a Coverdell Education Savings Account

Images related to the topicOpening Up a Coverdell Education Savings Account

What is a Coverdell Education Savings Account quizlet?

STUDY. What is a Coverdell Education Savings Account (Coverdell ESA)? Its a tax-advantaged education savings account designed for paying qualified elementary, secondary or higher education expenses of a beneficiary.

What type of plan is a Coverdell Education Savings Account?

A Coverdell education savings account (Coverdell ESA) is a type of savings plan used to set aside money for education expenses. Coverdell ESAs build upon a previous individual retirement arrangement called an education IRA by expanding annual contribution limits from $500 to $2,000.

Where can I get a Coverdell education savings account?

| ESA Sponsor | Custodian | Account Fee |

|---|---|---|

| Charles Schwab & Co. | Charles Schwab & Co. Inc. | None |

| E*Trade | E*Trade Clearing LLC | None if electing online statements |

| TD Ameritrade | TD Ameritrade Clearing, Inc. | None |

| Thrivent Mutual Funds | Thrivent Trust | $15, waived |

Where can you open a Coverdell Education Savings Account Answers?

You can open a Coverdell ESA at some banks, brokerage firms or mutual fund companies. As part of the account, you may be able to opt for certain investment products.

Can a Coverdell be rolled into a Roth IRA?

No. The 529 and Coverdell College Savings accounts are funds that are only for qualified education expenses. A 529 is a tax-advantaged savings account. The dollars are intended for education expenses, and typically can’t be rolled over to an IRA.

Can you pay student loans with Coverdell ESA?

Student loan repayment.

Coverdell education savings accounts cannot be used to repay student loans.

Can you roll Coverdell into 529?

Coverdell ESA owners may roll funds into a 529 plan for the same beneficiary without tax consequences. The distribution is tax-free when the 529 plan is funded within 60 days. A Coverdell ESA to 529 plan rollover may also be done as a trustee-trustee transfer.

Is a Coverdell an IRA?

An education IRA — formally called a Coverdell Education Savings Account — lets you save for your children’s college education while giving you a tax break. Educational IRAs are similar to 529 education savings plans administered by the states, with some important distinctions.

Does Coverdell Education Savings Account include room and board?

What expenses are covered by Coverdell ESAs? Coverdell ESAs can be used only to pay for qualified education expenses, such as tuition and fees; the cost of books, supplies and other equipment; and in some situations, the cost of room and board.

What savings account will earn you the most money?

Rates and minimum balance: CDs tend to pay the highest interest rates of the three types of savings accounts. They typically require around $1,000 to open, but there are CDs with no minimum starting balance requirement. CDs generally don’t charge a monthly fee.

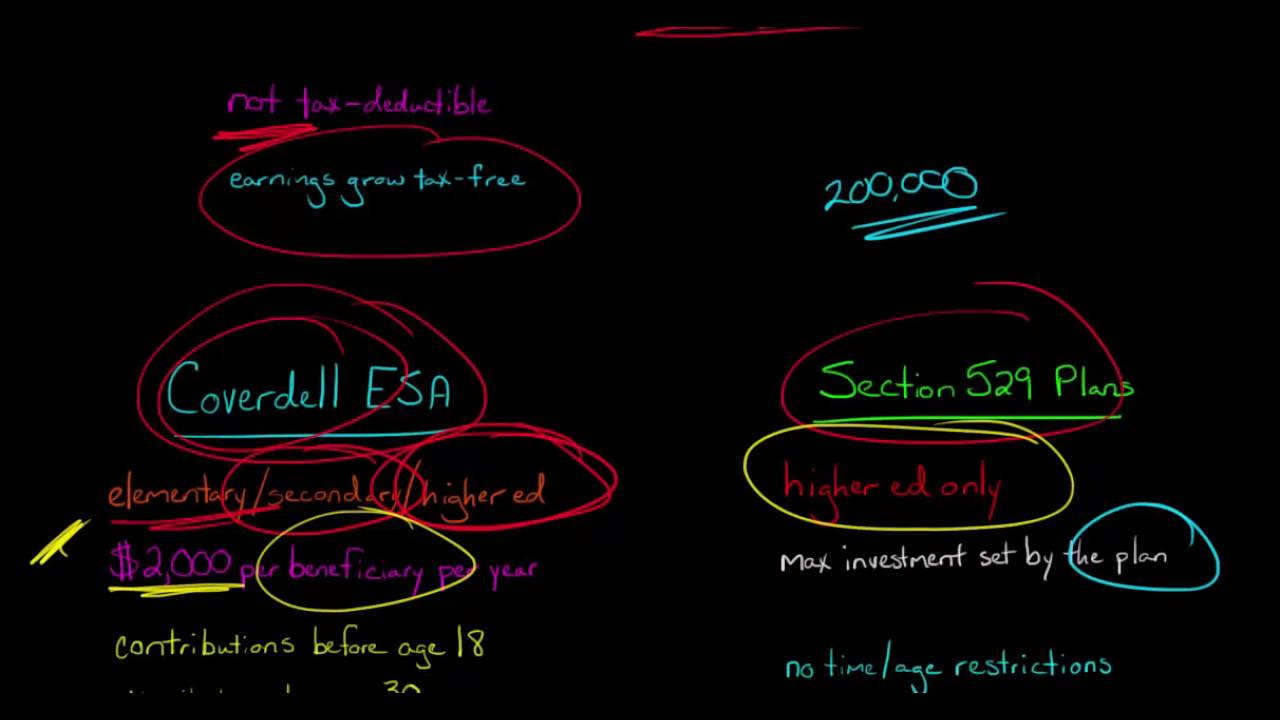

Coverdell Education Savings Account (ESA)

Images related to the topicCoverdell Education Savings Account (ESA)

How do I cash out my Coverdell ESA?

- Complete a Coverdell ESA distribution request form from the financial institution that holds the Coverdell ESA. …

- Submit the withdrawal request to the financial institution. …

- Spend the proceeds on qualified education costs to avoid taxation.

Who owns Coverdell education?

Who owns the ESA? Me or my child? While your child is the beneficiary of the Coverdell ESA, you are the owner of the account. Although you must use the funds to cover your child’s educational expenses, your kiddo does not get control of the fund at any point.

Is a Coverdell Education Savings Account the same as a 529?

Regarding elementary and secondary schools, the important distinction between a 529 plan and a Coverdell ESA is how tuition and expenses are handled. A 529 plan, when used for elementary and secondary schools only, is limited to tuition, while a Coverdell ESA can pay for elementary or secondary school expenses as well.

Does Vanguard offer Coverdell ESA?

Education savings account (ESA) An account that can be used for any level of education (kindergarten through postsecondary). Vanguard no longer opens new ESAs (also known as “Coverdell ESAs”), nor do we allow new ESAs to be created with money from an account transfer.

Do Coverdell accounts still exist?

Yes, The Coverdell ESA Still Exists – And Here’s Why You Should Care.

Can grandparents open a Coverdell account?

Coverdell Education Savings Accounts. Grandparents who have earned income can directly open one of these accounts for a grandchild under the age of 18 and contribute up to $2,000 a year. If they do not have earned income, they could gift the money to the parents to open the account.

What happens to 529 funds that are not used?

If you truly have no other use for your leftover 529 plan savings, you can always take a non-qualified distribution. Your contributions will never be taxed or penalized, since they were made with after-tax dollars. Any earnings on your investments, however, will be subject to income tax as well as a 10% penalty.

How many times per year can a 529 plan account holder move funds?

Can I switch my investments around? IRS regulations only allow you to exchange money from your current 529 investment options to a different option twice per calendar year. (The automatic changes within Target Enrollment Portfolios don’t count.)

Which of the following is a characteristic of the Coverdell Education Savings Account?

Which of the following is a characteristic of Coverdell ESAs? Coverdell Education Savings Accounts allow for $2,000 a year to be contributed to pay for a child’s education expenses. There is no tax deduction for the contribution and the account grows tax free, as long as the funds are used to pay for school expenses.

What can I do with unused Coverdell funds?

Roll it over: You can roll over unused Coverdell money to another account for an eligible family member, or you can change the beneficiary for the current account. You can also transfer it to a 529 plan, which is a qualified distribution, to avoid the tax penalty.

Section 529 Plans vs. Coverdell Education Savings Accounts

Images related to the topicSection 529 Plans vs. Coverdell Education Savings Accounts

Are Coverdell contributions tax deductible?

Contributions. You may be able to contribute to a Coverdell ESA to finance the beneficiary’s qualified education expenses. Contributions must be made in cash, and they’re not deductible. Any individual whose modified adjusted gross income is under the limit set for a given tax year can make contributions.

Can I reimburse myself from Coverdell?

Although you can reimburse yourself, it’s important to make sure that the expenses that you reimburse yourself for are qualified expenses. Two important things to remember about qualified expenses: Qualified expenses include tuition, books, computers and tech, other school equipment, room and board.

Related searches

- which of the following is a tax advantaged savings plan designed

- which of the following is a characteristic of the coverdell education savings account

- which of the following makes the coverdell education savings account

- to whom do you go if you want to enroll in a coverdell education savings account

- where can you open a coverdell education savings account brainly

- when is the enrollment period for a 529 college savings plan

- which of the following is a characteristic of the college savings plan apex

- the amount of money you make on the college savings plan investment is dependent on apex

Information related to the topic where can you open a coverdell education savings account apex

Here are the search results of the thread where can you open a coverdell education savings account apex from Bing. You can read more if you want.

You have just come across an article on the topic where can you open a coverdell education savings account apex. If you found this article useful, please share it. Thank you very much.