Let’s discuss the question: what payment method typically charges the highest interest rates. We summarize all relevant answers in section Q&A of website Countrymusicstop.com in category: MMO. See more related questions in the comments below.

Table of Contents

Which source of credit typically requires the highest interest rate?

For this reason, unsecured lines of credit often require a higher minimum credit score to qualify, come with higher interest rates and have lower limits. When taking out a secured line of credit, the borrower uses an asset, like a home or car, as collateral to guarantee—or secure—the debt.

What are the method of interest charging?

Traditionally, there are two common methods used for calculating interest: (i) the 365/365 method (or Stated Rate Method) which utilizes a 365-day year; and (ii) the 360/365 method (or Bank Method) which utilizes a 360-day year and charges interest for the actual number of days the loan is outstanding.

What do Rising Interest Rates Mean?

Images related to the topicWhat do Rising Interest Rates Mean?

Which payment can have interest charged to you?

Checks and Debit Cards both withdraw money directly from a bank account. Debit Cards often have a higher interest rate than Credit Cards. Debit cards offer the highest level of fraud protection. Checks and Debit Cards both withdraw money directly from a bank account.

Which lending institution charges the highest interest rate has the largest default rate?

Bank credit cards tend to have the highest default rate, which is reflected in the S&P/Experian Bankcard Default Index. The default rate on credit cards was 3.28%, as of January 2020.

What is the highest interest rate a credit card company can charge?

There is no federal law that limits the maximum credit card interest rate that a credit card company can charge. An exception would be a couple federal laws that limit interest rates charged for active duty servicemembers or their dependents.

How high can credit card interest rates go?

Currently, the average interest rate on cards is about 16%, but rates can go as high as 25% or more. The Federal Reserve Board is expected to start raising short-term interest rates in March in an effort to keep inflation in check.

What is the most common method of interest calculation quizlet?

The two most common methods of calculating interest are compound and simple interest formulas. Simple interest is the interest computed on principal only and without compounding; it is the dollar cost of borrowing money.

What are 3 different methods of calculating interest?

- Fixed Flat.

- Declining Balance.

- Declining Balance (Equal Installments)

Which is method to calculate interest?

✅What is the formula to calculate simple interest? You can calculate Interest on your loans and investments by using the following formula for calculating simple interest: Simple Interest= P x R x T ÷ 100, where P = Principal, R = Rate of Interest and T = Time Period of the Loan/Deposit in years.

What is interest charge?

This refers to the sum of interest on your credit card account and it is broken down by transaction type: purchases, cash advances and balance transfers. You will be charged interest if you pay less than the full balance or pay after the payment due date.

What is interest charge purchase on TD Visa?

When you signed up for your Credit Card you were given an annual interest rate that applies to your purchases and another annual interest rate that applies to any cash advances you made. The purchase interest rate will apply to any purchases you make if you do not pay your balance in full by the payment due date.

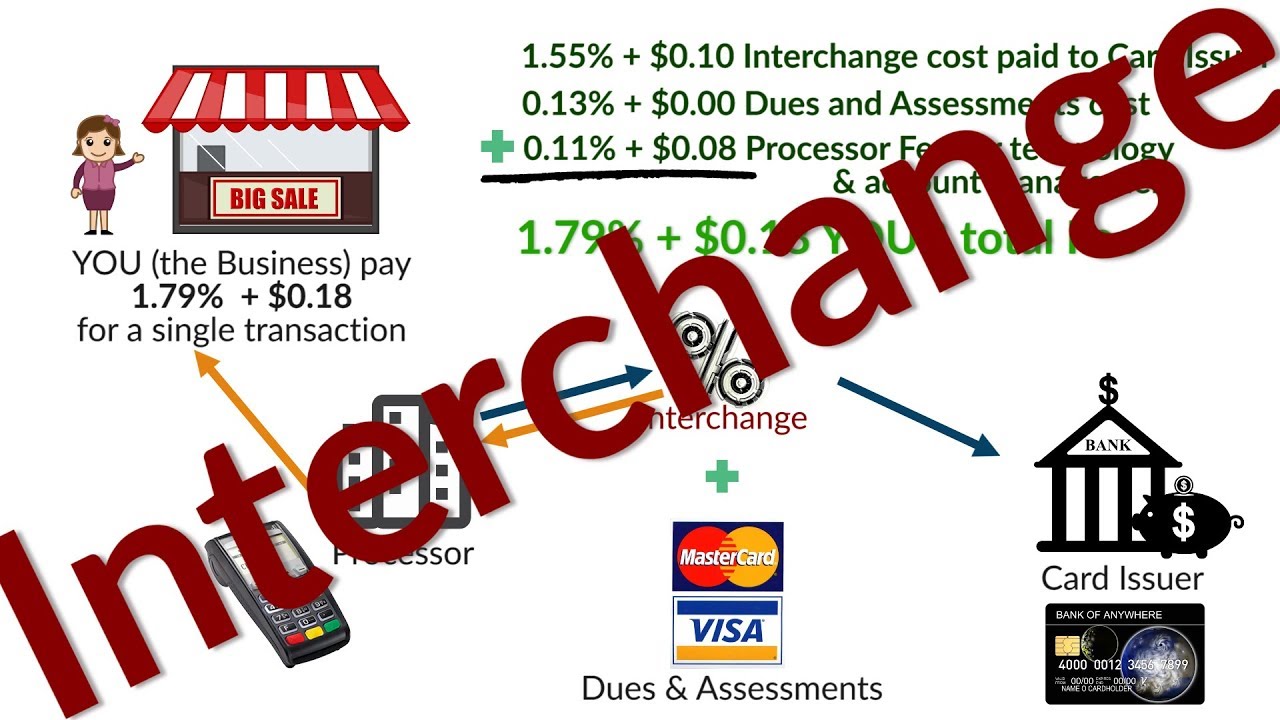

Merchant Account Pricing – What Is Interchange – Fees, Rates and Why it’s important to you!

Images related to the topicMerchant Account Pricing – What Is Interchange – Fees, Rates and Why it’s important to you!

Which method of payment is a form of borrowing money?

It also might mean that you get a loan. A loan is another way to use credit. Using credit means you borrow money to buy something. You borrow money (with your credit card or loan).

What is the highest interest rate that can be charged on a loan in Georgia?

| Legal Maximum Rate of Interest | 7% per year when rate not specified; higher than 7% must be in writing; maximum 16% where principal is $3000 or less; no limit on rate if loan is between $3000 and $250,000 and must be in simple interest in written contract (§7-4-2) |

|---|---|

| Exceptions | Small industrial loans (§7-3-14) |

What is the highest legal interest rate on a personal loan?

The maximum personal loan interest rate allowable by law depends on what state you live in. Generally, personal loans don’t charge more than 36%, but some can charge up to a few hundred percent. You should also beware of payday loans, which can charge fees equivalent to a 400%+ APR.

What is the highest interest rate allowed on a mortgage?

For licensees and registrants under the Mortgage Brokers, Lenders, and Servicers Licensing Act (MBLSLA), MCL 445.1651 et seq., and the Secondary Mortgage Loan Act (SMLA), MCL 493.51 et seq., the maximum annual rate of interest allowed to be charged on a mortgage loan is 25%, inclusive of finance charges (APR).

Why do credit card companies charge such high interest rates?

In finance, generally the more risk you take, the better potential payoff you expect. For banks and other card issuers, credit cards are decidedly risky because lots of people pay late or don’t pay at all. So issuers charge high interest rates to compensate for that risk.

What is the maximum interest rate in the United States quizlet?

Adopted in 1918 as a consumer protection referendum, the first Califormia usury laws set the maximum interest rate at 12% for all lenders – no exceptions.

Is charging high interest illegal?

When Did Usury Become Illegal? Usury has a long history. It has primarily become illegal to prevent individuals from predatory loan practices; situations in which people need to borrow money but are charged a high interest rate, often resulting in difficulty paying back the loan with interest and/or financial ruin.

How do interest rates on credit cards work?

How Credit Card Interest Works. If you carry a balance on your credit card, the card company will multiply it each day by a daily interest rate and add that to what you owe. The daily rate is your annual interest rate (the APR) divided by 365. For example, if your card has an APR of 16%, the daily rate would be 0.044%.

What method is used to calculate the monthly finance charge for Mastercard?

Average daily balance is calculated by adding each day’s balance and then dividing the total by the number of days in the billing cycle. That number multiplied by one-twelfth your annual percentage rate, or APR, equals your monthly finance charge. This is considered the most common method.

What is the most common method of interest calculation?

The two most common methods of calculating interest are simple interest and compound interest. Simple Interest (S.I.) is the method of calculating the interest amount for some principal amount of money. Interest is computed on the principal amount only and without compounding.

Why Global Supply Chains May Never Be the Same | A WSJ Documentary

Images related to the topicWhy Global Supply Chains May Never Be the Same | A WSJ Documentary

What is the most common method of calculating the cost of credit?

Average Daily Balance.

This is the most common calculation method. It credits your account from the day the issuer receives your payment. To figure the balance due, the issuer totals the beginning balance for each day in the billing period and subtracts any credits made to your account that day.

What is the average interest rates for credit cards quizlet?

The common range of interest rates on credit cards is between 15% and 20% on an annualized basis and does not vary much over time.

Related searches

- what is a credit union?

- what is a credit union

Information related to the topic what payment method typically charges the highest interest rates

Here are the search results of the thread what payment method typically charges the highest interest rates from Bing. You can read more if you want.

You have just come across an article on the topic what payment method typically charges the highest interest rates. If you found this article useful, please share it. Thank you very much.