What is float balance and uncleared balance?

Think of it this way: Uncleared balances happen when you deposit a check, but the funds haven’t been fully processed yet. It’s like the check is still “floating” in the banking system! The bank hasn’t officially added those funds to your account. This is because the check needs to be cleared by the issuing bank.

This usually takes a couple of business days. Once the check is cleared, the funds become part of your available balance, which is the amount you can use right away.

So, the uncleared balance is the amount of funds that haven’t been added to your available balance yet.

Let me give you a real-world example:

You deposit a check for $100 on Monday. The bank shows the $100 as a float balance because it’s still pending. Until the check clears, you can’t use that $100. If your available balance is $50, you can only spend that $50. Once the check clears, your available balance increases to $150. The money in your float balance will then become part of your available balance.

What is an unclear balance in a bank account?

Let’s break it down further. Imagine you’re sending money to a friend. You initiate the transfer, and the money is marked as “pending” in your account. This is because the transaction hasn’t been fully processed yet. The funds haven’t left your account, and your friend hasn’t received them. This is an example of an uncleared balance.

Another scenario is when you receive a payment. Your friend might have already transferred funds to you, but the money hasn’t reached your account yet. This is because the transaction might still be in transit, awaiting confirmation from the other bank. Until that happens, the money appears as an uncleared balance. Once the transaction clears, the funds will be added to your available balance.

Essentially, the uncleared balance acts as a buffer, showcasing transactions that are still in progress. It’s a temporary state, and the balance will change as soon as the transactions are finalized. You’ll see your available balance update accordingly. This process can take some time, depending on the payment method and the banks involved.

What is the difference between clear balance and ledger balance?

Clear balance is the amount of money you can actually spend right now. This balance takes into account any holds on your account. These holds are like temporary pauses on your funds. They might be for things like:

ATM transactions: When you withdraw cash at an ATM, the money isn’t immediately deducted from your account. It’s put on hold until the transaction is finalized.

Pending checks: If you’ve written a check, it won’t be deducted from your account until the recipient cashes it.

Deposited items: When you deposit a check or other item, it’s not immediately available for you to spend. The bank needs time to process the deposit and ensure it’s legitimate.

Ledger balance, on the other hand, is the total amount of money in your account, including any holds. It’s the balance according to the bank’s records.

Think of it this way:

Ledger balance is like the full pie.

Clear balance is like the slice of pie you can eat right now, after you remove the hold on that particular piece.

Understanding these two balances is important for managing your finances effectively. If you’re planning a large purchase, always check your clear balance to make sure you have enough funds available. You don’t want to accidentally overdraw your account!

It’s also worth noting that the specific details of holds can vary from bank to bank. It’s always a good idea to check with your bank for their specific policies regarding holds and balances.

What is a floating balance?

Think of it like this: You transfer money to a friend. Your bank might take a little while to process the transaction and debit your account. However, your friend’s bank might immediately credit their account as soon as the transfer request arrives. During this short period, you’ll see a lower balance in your account, while your friend will see a higher balance in their account. This temporary difference is known as a floating balance.

This situation is quite common in the financial world and usually resolves quickly. As the payer’s bank processes the transaction, the funds will be debited from the payer’s account, bringing the balances back into alignment. The length of time it takes for a floating balance to clear can vary depending on the banks involved and the transaction volume. It’s generally a very short-lived situation, and you don’t need to worry about it unless it persists for an unusual amount of time. If you have any concerns, it’s always a good idea to contact your bank to ensure everything is processed correctly.

What is a float balance?

Think of it like this: You write a check to a friend for $100. They deposit the check into their bank. Their bank shows $100 in their account, but your bank hasn’t deducted the $100 from your account yet. This “extra” $100 in your friend’s account is considered float.

The amount of float can vary depending on a few factors:

How long it takes for checks to clear: This can be affected by things like the distance between banks, holidays, and the volume of checks being processed.

The type of check: Electronic checks typically clear faster than paper checks.

Bank policies: Some banks may hold checks for a longer period of time before releasing funds.

Float can be a good thing for businesses because it gives them a temporary source of funds. However, it’s important to note that this is a temporary solution, and the funds will eventually be deducted from your account. For example, if you are constantly using float to cover expenses, it can lead to overdraft fees. It’s a good practice to keep track of your float balance and ensure that you have enough funds available to cover your expenses.

What is the difference between available balance and cleared balance?

Your available balance is the money you can access right now. Banks are legally required to make a portion of your deposits available quickly, often within a few days. But that doesn’t mean the funds have been officially transferred from the person who wrote the check.

Cleared balance is the money that’s definitely yours. It’s the amount that’s been deducted from the original account and confirmed by the bank. It can take a few days for a check to clear, depending on the bank and the type of check.

Think of it this way:

Available balance is like having a gift card with a certain amount loaded on it. You can use it, but the money hasn’t actually been transferred to your account yet.

Cleared balance is like cash in your pocket. It’s yours to spend, and the bank knows it’s yours.

A Practical Example

Let’s say you deposit a check for $100. The bank might show you a available balance of $100, but the check hasn’t cleared yet. This means the bank is giving you access to the funds *before* they have officially confirmed the check is valid. If the check bounces, your account will be debited for that amount.

In the meantime, you can withdraw that $100 or use it to pay bills. But, until it’s a cleared balance, the bank has the right to deduct the amount if the check turns out to be bad.

The Bottom Line

Always check your cleared balance to see how much money you have truly available to spend. While your available balance might look good, it’s always best to be cautious and keep in mind that not all of it might be fully yours until it clears.

What does unclear money mean?

So, what can cause money to be uncleared? It could be a few things! Maybe you deposited a check, and the bank needs to verify that it’s legit. Or maybe you made a transfer from another account, and the funds haven’t settled yet. In some cases, it could be due to technical issues on the bank’s end. Don’t worry though! This is usually temporary. It might take a day or two, maybe even a few business days, but the funds will eventually clear.

Now, let’s take a closer look at the two types of transactions:

Uncleared transactions represent money that hasn’t been verified by the bank. You’ll see this in your account balance, but you can’t really spend it yet. It’s like money in limbo!

Cleared funds are the real deal! These transactions have been confirmed by the bank, and you can spend them freely. It’s the money you can count on.

The difference between uncleared and cleared funds can sometimes be confusing, but it’s important to know the difference! It’s all about understanding how your money moves around your account. If you ever have questions about a specific transaction, don’t hesitate to reach out to your bank! They’re happy to explain things.

Can I withdraw an uncleared balance?

Uncleared balance is usually the result of a deposit that’s still being processed by the bank. This could be a deposit made through an ATM, a mobile banking app, or a check that’s been deposited. The bank needs time to verify the deposit and ensure that the funds are available before they can be credited to your account.

Here’s a breakdown of why you can’t withdraw uncleared balances:

Safety: The bank needs to make sure the funds are legitimate before allowing you to access them. This helps to protect both the bank and you from potential fraud or errors.

Processing Time: It takes time to process transactions, especially when it involves third-party institutions like other banks or financial institutions.

What can you do while you wait for your deposit to clear?

Check Your Account Activity: Keep an eye on your account statements and online banking activity to see when the funds are credited.

Contact Your Bank: If you’re unsure about the status of your deposit, contact your bank directly. They can provide you with an update and an estimated timeframe for when the funds will be available.

Remember, uncleared balance is simply a temporary state. The funds will eventually be credited to your account, and you’ll be able to withdraw them as usual.

See more here: What Is An Unclear Balance In A Bank Account? | Float Balance And Unclear Balance

What is a floating balance?

This usually happens because banks take a little time to process transactions. It’s kind of like the money is “floating” in the air between the two banks before it settles. It can be a bit confusing, but it’s completely normal and usually gets sorted out quickly. The process of transferring money from one bank to another involves a series of steps and communication between the banks. This communication, while generally quick, can occasionally experience minor delays. It’s like a relay race, where each bank passes the baton of the transaction to the next.

One way to think about it is like a game of telephone. When you whisper something to someone, it’s passed down the line and can sometimes get a little distorted by the time it reaches the end. Similarly, with bank transfers, there’s a chance for a slight delay in the message being relayed between the banks.

It’s important to remember that floating balances are temporary. Once the transaction is fully processed, both accounts will reflect the correct balance. The money is safe, and it’s just a matter of waiting for the banks to catch up with each other.

What is the difference between cash balance and float?

The cash balance on a company’s books, also known as the ledger balance, is the amount of money the company believes it has on hand. This balance is based on the company’s accounting records. On the other hand, the available balance or collected balance is the amount of money the company actually has in its bank account.

The float is the difference between these two balances. It essentially represents the time lag between when a company records a transaction and when the bank actually processes it.

Here’s an example: Imagine you write a check to a supplier. You record the transaction in your books immediately, reducing your ledger balance. However, the supplier won’t deposit the check until later. Until then, your bank won’t recognize the transaction, and your available balance remains unchanged. The difference between these two balances is the float.

There are two main types of float:

Disbursement float: This happens when a company writes a check but the bank hasn’t yet debited the company’s account. This means that the company’s ledger balance is lower than its bank balance.

Collection float: This occurs when a company receives a check, but the bank hasn’t yet credited the company’s account. This means that the company’s ledger balance is higher than its bank balance.

Float can be a complex topic, but understanding it is essential for businesses to manage their cash flow effectively.

Understanding the float helps businesses:

Reconcile their bank statements: Reconciling their bank statements is a critical part of any company’s accounting process. The float helps explain discrepancies between the company’s records and the bank’s records.

Forecast cash flow: Knowing the float can help companies forecast their cash flow more accurately. This can be especially important when planning for major expenses or investments.

Improve cash management: By understanding the float, companies can take steps to minimize the time it takes for checks to clear and maximize the time it takes for deposits to be credited.

To ensure accurate financial reporting and smooth cash flow management, companies should strive to minimize the float by managing their payments and collections efficiently. This could involve using electronic payments and encouraging customers to pay electronically.

What is a positive net float?

Let’s break down the concept of positive net float and what it means for a business.

The net float is simply the difference between what your company’s internal records show as the balance in your bank account and what the bank actually shows as the available balance.

A positive net float means your internal records show a higher balance than what the bank shows. This happens when the payment float (the time it takes for your payments to clear the bank) is greater than the collection float (the time it takes for your customers’ payments to be deposited into your account).

Here’s a real-world example:

Imagine you write a check to a supplier for $1,000. You record the payment in your books, but the check hasn’t cleared the bank yet. The bank’s balance shows $1,000 less than your internal books because that money hasn’t been deducted from your account yet. This is a payment float.

On the other hand, if a customer pays you $500, you won’t be able to use that money until it is deposited and cleared by the bank. This time lag is the collection float.

When the payment float is bigger than the collection float, you have a positive net float. This means your company has access to more funds than what is reflected in the bank’s records.

Why is a positive net float important?

A positive net float can be a good thing, as it means your business has more cash on hand than you might think. This extra cash can be used for various things, like:

Investing in growth: You can use the extra cash to expand your business, purchase new equipment, or hire more staff.

Managing cash flow: A positive net float helps you maintain a healthy cash flow, making it easier to meet your financial obligations and avoid liquidity issues.

Taking advantage of opportunities: If you have extra cash on hand, you are better equipped to seize investment opportunities or respond to unexpected expenses.

However, it is important to note that a positive net float can also be a sign of inefficiency.

Slow payments: A large payment float could mean your company is taking too long to process payments, which can hurt relationships with suppliers and delay important projects.

Inefficient collection practices: A small collection float could indicate a problem with your company’s collection processes. You might be losing money due to late payments or inefficient processes.

The key is to find a balance.

You want to maximize your positive net float without sacrificing efficiency or damaging relationships with your suppliers or customers. This involves optimizing your payment and collection processes, ensuring timely payments to suppliers while also collecting payments from your customers promptly.

What is net float?

Net float represents the difference between your company’s available bank balance and the balance shown in your company’s ledger. Think of it like this: Your bank knows how much money you actually have in your account, while your company’s books keep track of how much money you *think* you have.

A positive net float means you have more money in your bank account than your books show. This is because your payment float, the time it takes for your payments to be processed, is higher than your receipt float, the time it takes for your customers’ payments to be deposited.

Here’s a breakdown of net float:

Payment Float: This is the time it takes for your checks to be deposited and cleared by the bank. For example, if you write a check to a supplier, they might not deposit it right away, which gives you some time before the funds actually leave your account. This increases your available bank balance before your books reflect the payment.

Receipt Float: This is the time it takes for your customers’ payments to be deposited into your account. For example, if a customer mails you a check, there’s a delay between the time they mail it and when it actually gets deposited. This decreases your available bank balance before your books reflect the payment.

Let’s say you have a positive net float. This means your available bank balance is higher than your book balance. This is good for your company’s cash flow because you have more money available to spend, even though your books haven’t reflected the transactions yet.

On the other hand, a negative net float means your book balance is higher than your available bank balance. This could happen if your customers are quick to pay but your company takes a longer time to process payments. It means you might have fewer funds available than your books indicate.

Understanding net float is crucial for managing your company’s cash flow efficiently. By monitoring the difference between your available bank balance and your book balance, you can make informed decisions about spending and investing.

See more new information: countrymusicstop.com

Float Balance And Unclear Balance: What’S The Difference?

You know that feeling when you’re juggling a million things at once, and you’re just trying to keep your head above water? That’s kind of what it’s like when you’re dealing with float balance and unclear balance.

These terms are used in the world of accounting to describe situations where your financial records don’t quite match up with reality. Let’s break down each one so you can get a better grasp of what they mean and how to deal with them.

Float Balance: It’s Not What You Think

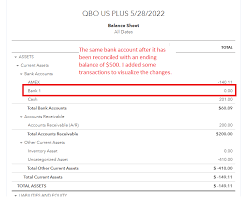

Float balance is a term that gets thrown around a lot, but it’s not always clear what it means. In the simplest terms, it refers to the difference between the amount of money you think you have on hand and the actual amount you have.

Think of it this way: You check your bank balance and see you have $1,000. You’re feeling good! But then you go to pay for something, and your card gets declined. Turns out, you only have $500 in your account. That’s a float balance of $500.

Why does this happen? There are a few reasons:

Timing: A common reason for float balance is timing. Let’s say you deposit a check into your account, but the bank hasn’t processed it yet. You might see the money in your account online, but it’s not actually available to spend.

Deposits and Withdrawals: Another reason is delays in processing deposits or withdrawals. Imagine you write a check to a vendor, but they haven’t cashed it yet. You might think you have that money, but it’s actually gone from your account.

Errors: Sometimes float balance happens because of errors in your accounting records or your bank’s records.

Unclear Balance: A Foggy Picture

Now, let’s talk about unclear balance. This is a bit trickier to define because it’s more of a broad concept. Unclear balance describes a situation where you’re not sure about the accuracy of your financial records.

For example, let’s say you have a lot of outstanding invoices and you’re not sure which ones have been paid and which ones haven’t. You might also have unreconciled transactions in your account, making it tough to get a clear picture of your financial position.

Think of it like trying to read a map that’s missing some crucial pieces. You might have a general idea of where you’re going, but you’re not entirely sure.

The Importance of Float Balance and Unclear Balance

Understanding float balance and unclear balance is important for several reasons. It helps you:

Make accurate financial decisions: If you’re not sure how much money you really have, you can’t make sound decisions about how to spend it.

Avoid cash flow problems: Float balance can lead to cash flow problems if you don’t manage it correctly. Imagine you’re relying on a check that hasn’t cleared yet, and you end up overspending.

Prevent fraud: Unclear balance can be a sign of fraud. If you see discrepancies in your records, it’s important to investigate.

Tips for Managing Float Balance and Unclear Balance

Here are some tips for managing float balance and unclear balance:

Reconcile your accounts regularly: This means comparing your bank statements to your own records and making sure everything matches up.

Keep track of all deposits and withdrawals: Be sure to record all transactions accurately and promptly.

Use a budgeting tool: This can help you track your spending and make sure you’re staying within your means.

Be aware of processing times: Know how long it takes for deposits and withdrawals to be processed. This will help you avoid surprises.

Examples of Float Balance and Unclear Balance

Let’s illustrate these concepts with a few examples:

Float Balance:

* You deposit a check for $1,000 into your account, but it takes a few days for the funds to clear. You think you have $1,000, but you only have $500.

* You withdraw $500 from your account, but the withdrawal hasn’t been processed yet. You think you have $500, but you actually have $1,000.

* You make a purchase online and pay with your credit card. You might see a pending charge on your account statement, but the funds haven’t been deducted yet.

Unclear Balance:

* You have several outstanding invoices, but you don’t know which ones have been paid. You’re not sure how much money you’re owed.

* You have a lot of unreconciled transactions in your account. You can’t tell which transactions are real and which ones might be errors.

* You receive an unexpected credit card statement with a high balance. You can’t figure out where the charges came from.

FAQs about Float Balance and Unclear Balance

Here are some frequently asked questions about float balance and unclear balance:

Q: What is the difference between float balance and unclear balance?

A:Float balance is the difference between the amount of money you think you have on hand and the actual amount you have. Unclear balance describes a situation where you’re not sure about the accuracy of your financial records.

Q: How can I prevent float balance?

A: Reconcile your accounts regularly, keep track of all deposits and withdrawals, and be aware of processing times.

Q: How can I prevent unclear balance?

A: Maintain accurate records, reconcile your accounts regularly, and use a budgeting tool.

Q: What should I do if I have a float balance?

A: Contact your bank to clarify the situation. Make sure you understand why the float balance exists and how to resolve it.

Q: What should I do if I have an unclear balance?

A: Investigate the cause of the unclear balance. Look for discrepancies in your records and contact your bank if necessary.

Q: How can I improve my understanding of float balance and unclear balance?

A: Take a basic accounting course or read books and articles on financial management.

Key Takeaways

Float balance and unclear balance are important concepts in accounting that can impact your financial decisions.

Float balance is the difference between what you think you have and what you actually have.

Unclear balance is a situation where you’re not sure about the accuracy of your records.

* Managing float balance and unclear balance can help you avoid cash flow problems, make accurate financial decisions, and prevent fraud.

Reconciling your accounts regularly is a key step in managing both float balance and unclear balance.

By understanding these concepts and taking proactive steps to manage your financial records, you can ensure that your money is working for you, not against you.

What is float? | AccountingCoach

Definition of Float. In accounting and bookkeeping, float is the time between the writing of a check and the time that the check clears the bank account on which it is drawn. Examples of Float. Payer Corporation writes a check for $5,000 and mails it to a supplier on AccountingCoach

What Is the Float in Finance? (Plus How To Calculate It)

If you’re interested in financial literacy, you may want to learn more about float to understand how it affects investing, payments and insurance. In this article, we Indeed

Float: Meaning and Types | Financial Management

The net float at a point of time is simply the overall difference between the firm’s available bank balance and the balance shown by the ledger account of the firm. If the net float is Accounting Notes

Float – Overview, Issues, Kiting, Advancements

Float refers to the money that is double counted due to delays in the process of deducting funds from the payer and the depositing of the payee. Corporate Finance Institute

ICAI – The Institute of Chartered Accountants of India

The cash balance shown by a firm on its books is called the book or ledger balance whereas the balance shown in its bank accunts is called the available or collected ICAI – The Institute of Chartered Accountants of India

Float in Finance: Definition, Types, and Causes – Fincent

The net float is the difference between an organization’s internal ledger account balance and its balance in its bank account. A positive net float means that the ledger balance is fincent.com

Float – A Useful Tool for cash management – Tax Guru

The cash balance shown by a firm on its books is called the book or ledger balance whereas the balance shown in its bank accounts is called the available or Tax Guru

Cash Float Definition, Types & Examples – Lesson

The time it takes to clear a float balance, or “until the check clears,” varies between transactions. Some transactions can take several weeks. However, two to four days is a standard period… Study.com

Negative Float: Overview and Examples in Banking

A negative float is a net deficit resulting from checks that have been deposited but have not cleared bank records. Traditionally, a check writer keeps a Investopedia

Ball Float To X Float And Balance

Calculating For Net Float

How To Check The Balance Of Your D20 With The Dice Float Test – Original

Pineappleciti – Balance (Official Music Video)

How Do Ships Float? (3D Animation)

Link to this article: float balance and unclear balance.

See more articles in the same category here: blog https://countrymusicstop.com/wiki