Let’s discuss the question: what is the income tax formula in simplified form. We summarize all relevant answers in section Q&A of website Countrymusicstop.com in category: MMO. See more related questions in the comments below.

Table of Contents

What is the income tax formula?

Your Adjusted Gross Income (AGI) is then calculated by subtracting the adjustments from your total income. Your AGI is the next step in figuring out your taxable income. You then subtract certain deductions from your AGI. The resulting amount is taxable income on which your taxes are calculated.

What is the basic formula for any tax?

Understanding the Tax Base

To calculate the total tax liability, you must multiply the tax base by the tax rate: Tax Liability = Tax Base x Tax Rate.

How To Calculate Federal Income Taxes – Social Security \u0026 Medicare Included

Images related to the topicHow To Calculate Federal Income Taxes – Social Security \u0026 Medicare Included

What is the SS tax?

The current tax rate for social security is 6.2% for the employer and 6.2% for the employee, or 12.4% total. The current rate for Medicare is 1.45% for the employer and 1.45% for the employee, or 2.9% total.

What is basic taxable income?

Taxable income or gross income or adjusted gross income includes salaries, wages, bonuses, etc. along with unearned income and investment income. It is the amount that will be used to determine your tax liability.

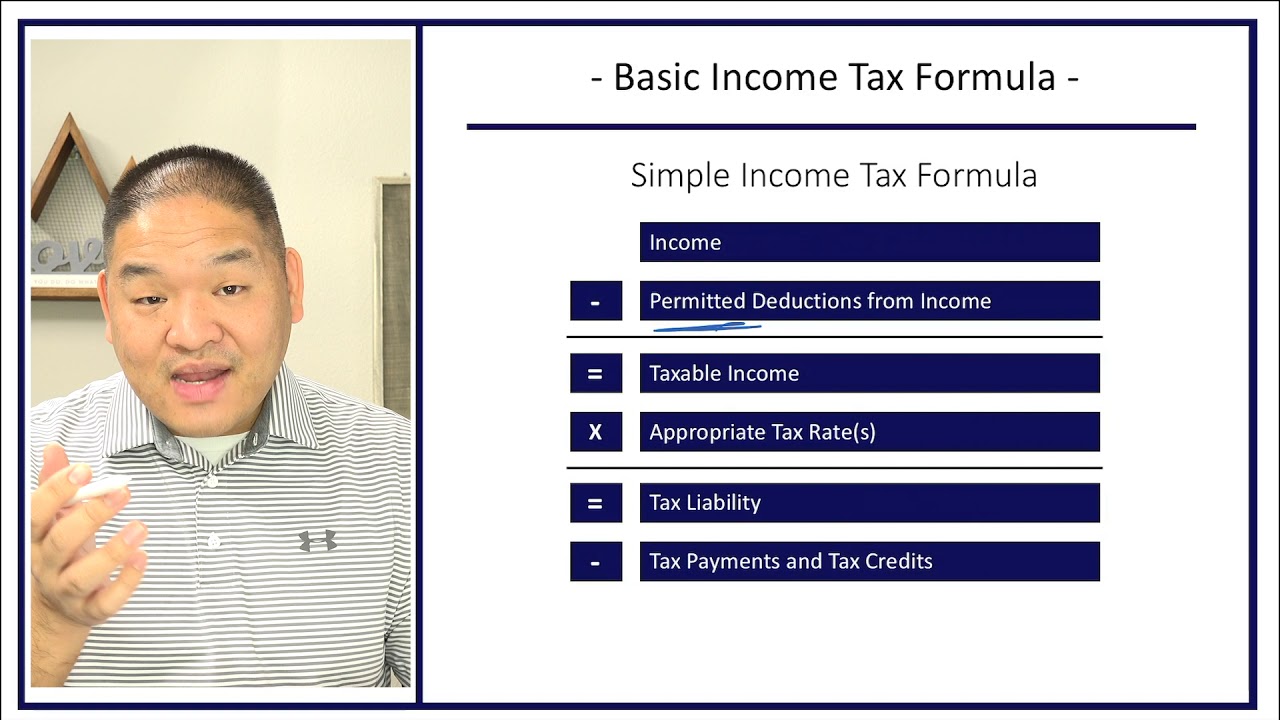

Taxation – Lesson 1.6 – Simple Income Tax Formula

Images related to the topicTaxation – Lesson 1.6 – Simple Income Tax Formula

What is federal individual income tax?

An individual income tax (or personal income tax) is levied on the wages, salaries, investments, or other forms of income an individual or household earns. The U.S. imposes a progressive income tax where rates increase with income.

How do I calculate taxable value from tax?

To find out the GST that is incorporated in a company’s receipts from items that are taxable, you need to divide the receipts by 1+ the applicable tax rate. Suppose the tax rate is 5%, then you need to divide the total sum of receipts by 1.05.

How do you calculate income tax on 1040?

- IRS Form 1040: Subtract line 46 from line 56 and enter the total.

- IRS Form 1040A: Subtract line 36 from line 28 and enter the total.

- IRS Form 1040EZ: Use Line 10.

How to Calculate your Income Tax? Step-by-Step Guide for Income Tax Calculation

Images related to the topicHow to Calculate your Income Tax? Step-by-Step Guide for Income Tax Calculation

What is a 1040 SR?

Specifically, Form 1040-SR allows you to report Social Security benefits as well as distributions from qualified retirement plans, annuities, or similar deferred-payment arrangements. You may also include unlimited interest and dividends and capital gains and losses.

What tax form is completed every April?

Form 1040 needs to be filed with the IRS by April 15 in most years. 1 Everyone who earns income over a certain threshold must file an income tax return with the IRS (businesses have different forms to report their profits).

Related searches

- what is the formula to calculate tax

- irs simplified method

- what is form 29c income tax

- how to calculate income tax

- income tax maths questions and answers pdf

- how to fill income tax calculation form

- what is the formula of income tax

- income tax problem solving

- what is income tax

- simplified tax method

- income tax math formula

- what is form 60 income tax

- form for income tax calculation

- what is form 36 income tax

- income tax math problems and solutions

- income tax related maths example and solution

Information related to the topic what is the income tax formula in simplified form

Here are the search results of the thread what is the income tax formula in simplified form from Bing. You can read more if you want.

You have just come across an article on the topic what is the income tax formula in simplified form. If you found this article useful, please share it. Thank you very much.