Let’s discuss the question: prepaid expenses reflect transactions when cash is paid. We summarize all relevant answers in section Q&A of website Countrymusicstop.com in category: MMO. See more related questions in the comments below.

Table of Contents

How are prepaid expenses recorded?

Prepaid expenses are not recorded on an income statement initially. Instead, prepaid expenses are first recorded on the balance sheet; then, as the benefit of the prepaid expense is realized, or as the expense is incurred, it is recognized on the income statement.

What happens to cash paid for expenses?

Cash payment. When an expense is recorded at the same time it is paid for with cash, the cash (asset) account declines, while the amount of the expense reduces the retained earnings account. Thus, there are offsetting declines in the asset and equity sections of the balance sheet.

Prepaid Expense Examples

Images related to the topicPrepaid Expense Examples

How are prepaid expenses treated in cash flow statement?

A decrease in prepaid expenses results in an increase in cash flow. Operating expenses are typically paid on a monthly basis, which is why any reduction in prepaid expenses will immediately benefit cash flow for the current month.

What is prepaid expenses journal entry?

The initial journal entry for prepaid rent is a debit to prepaid rent and a credit to cash. These are both asset accounts and do not increase or decrease a company’s balance sheet. Recall that prepaid expenses are considered an asset because they provide future economic benefits to the company.

Can you have prepaid expenses on cash basis?

Generally speaking, prepaid rent can be deducted by a cash basis taxpayer in the year of payment so long as the lease agreement calls for rent to be prepaid prior to the beginning of the month to which the rent payment relates.

Where do prepaid expenses appear?

Prepaid expenses represent future expenses paid in advance — so, until the associated benefits are realized, the expense remains a current asset. The prepaid expense is listed within the current assets section of the balance sheet until full consumption (i.e. the realization of benefits by the customer).

How do you record cash transactions?

Record any cash payments as a debit in your cash receipts journal like usual. Then, debit the customer’s accounts receivable account for any purchase made on credit. In your sales journal, record the total credit entry.

How do you handle cash transactions?

- Keep cash in the bank. When you run a cash business, you don’t have to wait for checks and credit card payments to process into an account. …

- Record every transaction. …

- Communicate to customers. …

- Manage petty cash fund. …

- Use Form 8300 for large sales.

When cash is paid on account the amount is recorded in the?

| A | B |

|---|---|

| When cash is received on account, the amount is recorded in the | Cash Debit column and General Credit column |

| A business form giving written acknowledgement for cash received | receipt |

| A form on which a brief message is written describing the transaction | memorandum |

Where do prepaid expenses appear on cash flow statement?

Several other non-cash items appear often on the cash flow statement, including prepaid expenses and unearned revenues. Prepaid expenses are assets on the balance sheet that do not reduce net income or shareholder’s equity. However, prepaid expenses do reduce cash.

How Prepaid Expenses Work | Adjusting Entries

Images related to the topicHow Prepaid Expenses Work | Adjusting Entries

How does a prepaid expense affect the statement of financial position?

Generally, the amount of prepaid expenses that will be used up within one year are reported on a company’s balance sheet as a current asset. As the amount expires, the current asset is reduced and the amount of the reduction is reported as an expense on the income statement.

Is prepaid expense an expense?

Prepaid expenses are future expenses that are paid in advance. On the balance sheet, prepaid expenses are first recorded as an asset. After the benefits of the assets are realized over time, the amount is then recorded as an expense.

Is prepaid expense a debit or credit?

From the perspective of the buyer, a prepayment is recorded as a debit to the prepaid expenses account and a credit to the cash account. When the prepaid item is eventually consumed, a relevant expense account is debited and the prepaid expenses account is credited.

Which of the following is an example of a prepaid expense?

An example of a prepaid expense is insurance, which is frequently paid in advance for multiple future periods; an entity initially records this expenditure as a prepaid expense (an asset), and then charges it to expense over the usage period. Another item commonly found in the prepaid expenses account is prepaid rent.

What is outstanding and prepaid expenses give journal entry with example?

…

Journal Entry for Prepaid Expenses.

| Prepaid Expense A/C | Debit | Debit the increase in asset |

|---|---|---|

| To Expense A/C | Credit | Credit the decrease in expense |

When can you deduct prepaid expenses?

The general rule is that you can’t prepay business expenses for a future year and deduct them from the current year’s taxes. An expense you pay in advance can be deducted only in the year to which it applies.

Can you be cash basis and have inventory?

Cash-basis accounting only lets you use cash accounts to track and record transactions. You can record things like cash, expenses, and income with the cash-basis method. But, you cannot track long-term liabilities, loans, or inventory. Businesses using cash basis record income when they receive it.

How does cash accounting work?

Cash accounting is an accounting method where payment receipts are recorded during the period in which they are received, and expenses are recorded in the period in which they are actually paid. In other words, revenues and expenses are recorded when cash is received and paid, respectively.

What is cash receipt and cash payment?

A cash receipt is a proof of purchase issued when the buyer has paid in cash. This cash receipt form is perfect for any industry and can be provided as proof of payment, or payment received. Cash receipts are the printed documents which are issued each and every time cash is received for a specific service or good.

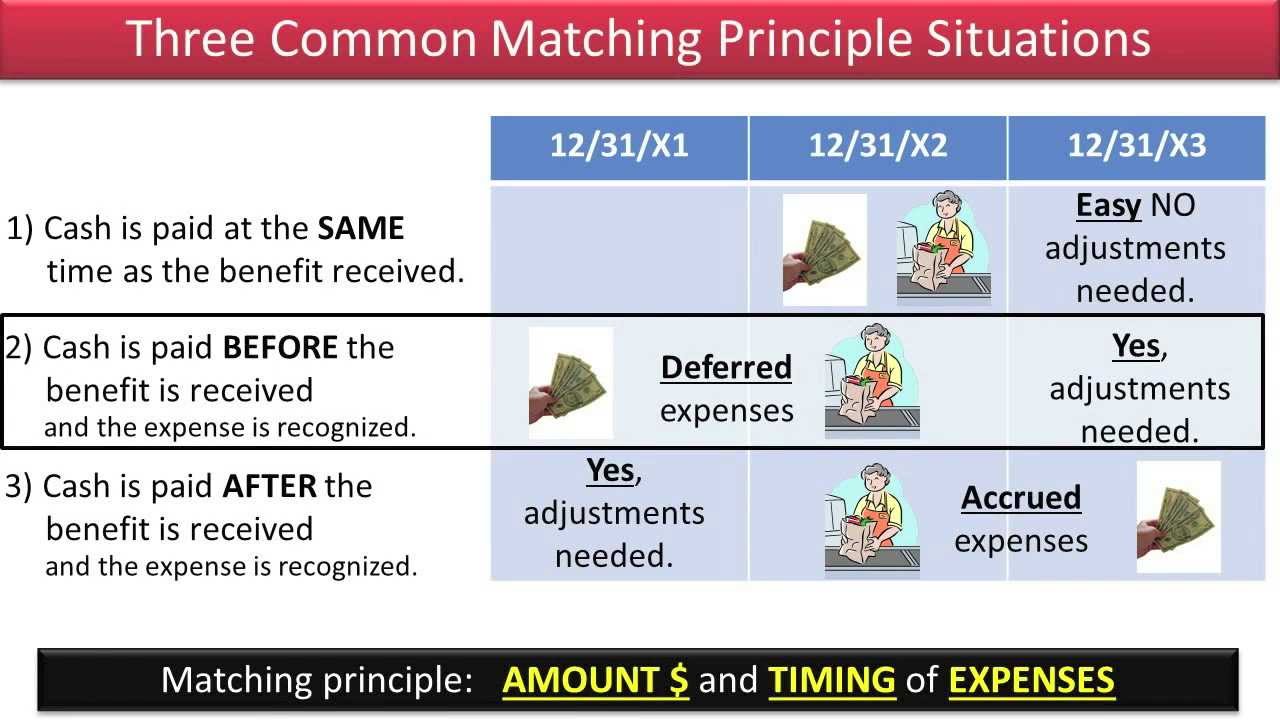

Deferred Expenses: Cash Is Paid Before Expense Is Recognized – Slides 1-3

Images related to the topicDeferred Expenses: Cash Is Paid Before Expense Is Recognized – Slides 1-3

What is cash transaction?

A cash transaction refers to a transaction which involves an immediate outflow of cash towards the purchase of any goods, services, or assets. Cash transaction can be consumer-oriented or business-oriented.

What is cash receipt and payment?

A cash receipt is a printed statement of the amount of cash received in a cash sale transaction. A copy of this receipt is given to the customer, while another copy is retained for accounting purposes. A cash receipt contains the following information: The date of the transaction.

Related searches

- income summary is a temporary account only used for the closing process quizlet

- what are cash transaction charges

- on november 1 the company rented space to another tenant

- if insurance coverage for the next two years is paid for in advance

- on january 1 the company purchased equipment that cost 10000

- record the 4800 paid in advance for two years of insurance coverage

- in the closing process which account balances will be transferred to retained earnings quizlet

- classify the following accounts into the correct financial statement using the drop-down list.

- does transferring money count as a transaction

- how does money reduce transaction costs

- which of the following are reported on the income statement

- record the $4,800 paid in advance for two years of insurance coverage

- the primary difference between accrual basis and cash basis accounting is

- deferred revenues reflect transactions when cash is paid

- does a prepaid expense have to be paid

Information related to the topic prepaid expenses reflect transactions when cash is paid

Here are the search results of the thread prepaid expenses reflect transactions when cash is paid from Bing. You can read more if you want.

You have just come across an article on the topic prepaid expenses reflect transactions when cash is paid. If you found this article useful, please share it. Thank you very much.