Let’s discuss the question: how much federal tax should i pay on 91000. We summarize all relevant answers in section Q&A of website Countrymusicstop.com in category: MMO. See more related questions in the comments below.

What percentage do I pay in federal income tax?

The U.S. currently has seven federal income tax brackets, with rates of 10%, 12%, 22%, 24%, 32%, 35% and 37%. If you’re one of the lucky few to earn enough to fall into the 37% bracket, that doesn’t mean that the entirety of your taxable income will be subject to a 37% tax. Instead, 37% is your top marginal tax rate.

How is federal tax withholding calculated?

- Multiplying taxable gross wages by the number of pay periods per year to compute your annual wage.

- Subtracting the value of allowances allowed (for 2017, this is $4,050 multiplied by withholding allowances claimed).

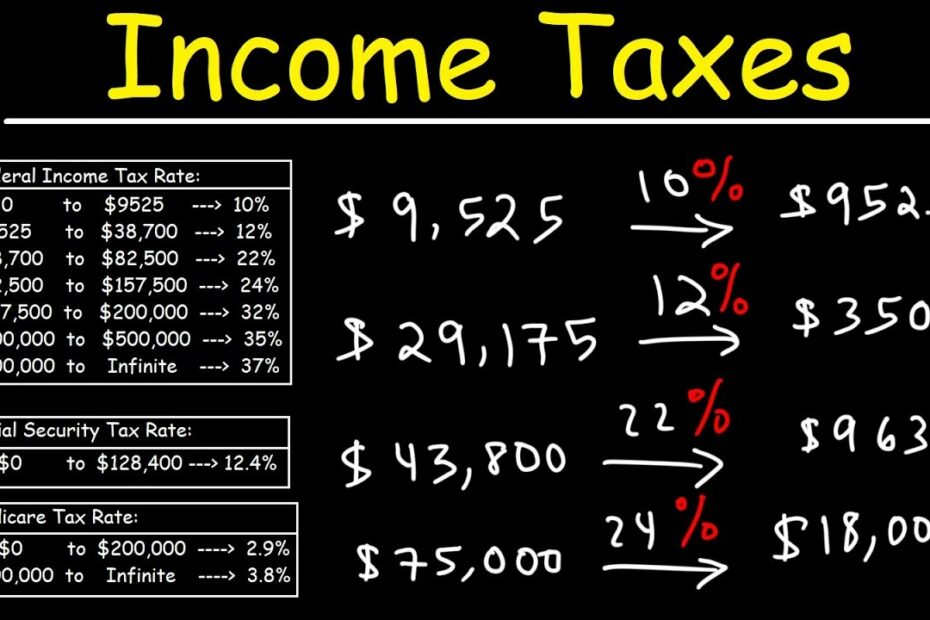

How To Calculate Federal Income Taxes – Social Security \u0026 Medicare Included

Images related to the topicHow To Calculate Federal Income Taxes – Social Security \u0026 Medicare Included

What is the federal tax rate for 2020?

| Rate | For Single Individuals | For Married Individuals Filing Joint Returns |

|---|---|---|

| 10% | Up to $9,875 | Up to $19,750 |

| 12% | $9,876 to $40,125 | $19,751 to $80,250 |

| 22% | $40,126 to $85,525 | $80,251 to $171,050 |

| 24% | $85,526 to $163,300 | $171,051 to $326,600 |

What is the federal tax rate for 2021?

| Tax rate | Single | Married filing jointly or qualifying widow |

|---|---|---|

| 10% | $0 to $9,950 | $0 to $19,900 |

| 12% | $9,951 to $40,525 | $19,901 to $81,050 |

| 22% | $40,526 to $86,375 | $81,051 to $172,750 |

| 24% | $86,376 to $164,925 | $172,751 to $329,850 |

How much federal tax should be taken out of my check?

How do I calculate taxes from paycheck? Calculate the sum of all assessed taxes, including Social Security, Medicare and federal and state withholding information found on a W-4. Divide this number by the gross pay to determine the percentage of taxes taken out of a paycheck.

How much should I be paying in taxes per paycheck?

| Gross Paycheck | $3,146 | |

|---|---|---|

| Federal Income | 15.22% | $479 |

| State Income | 4.99% | $157 |

| Local Income | 3.50% | $110 |

| FICA and State Insurance Taxes | 7.80% | $246 |

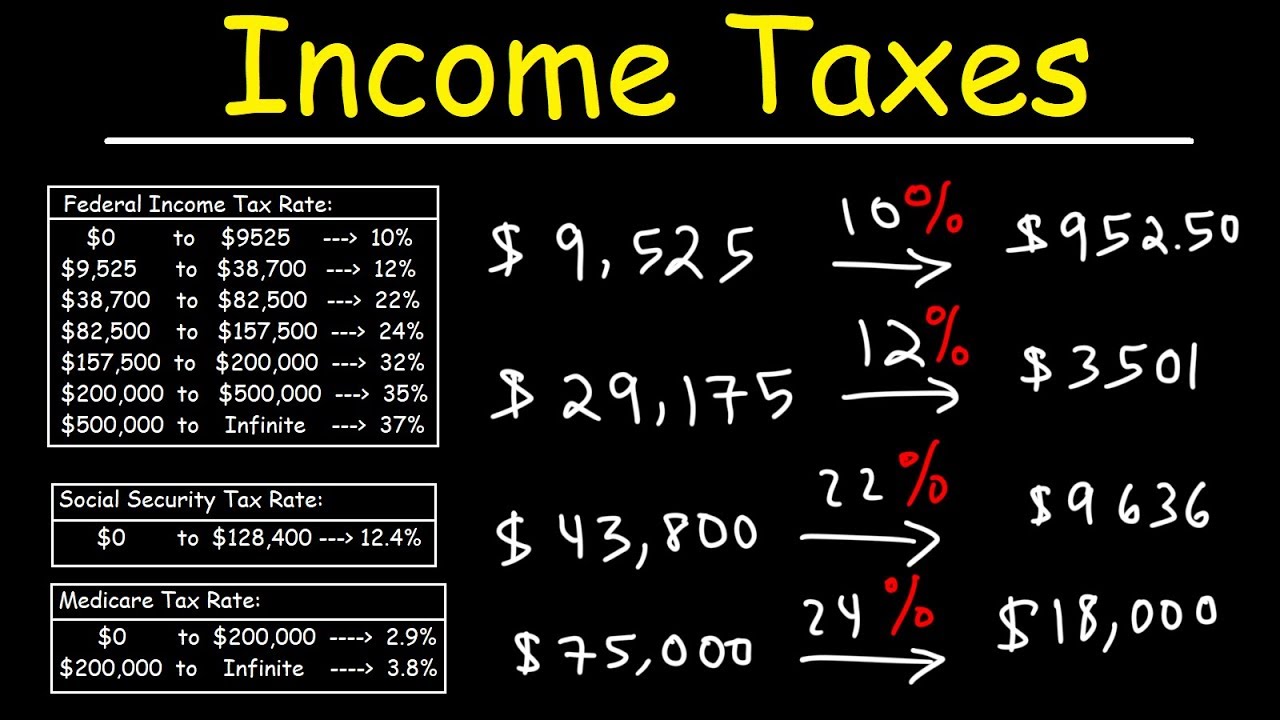

How to Calculate Your Federal Income Tax Liability | Personal Finance Series

Images related to the topicHow to Calculate Your Federal Income Tax Liability | Personal Finance Series

What is $1200 after taxes?

$1,200 after tax is $1,200 NET salary (annually) based on 2022 tax year calculation. $1,200 after tax breaks down into $100.00 monthly, $23.00 weekly, $4.60 daily, $0.58 hourly NET salary if you’re working 40 hours per week.

Why is there no federal withholding on my paycheck 2021?

If no federal income tax was withheld from your paycheck, the reason might be quite simple: you didn’t earn enough money for any tax to be withheld.

What is the federal tax rate on 80000?

If you make $80,000 a year living in the region of California, USA, you will be taxed $22,222. That means that your net pay will be $57,778 per year, or $4,815 per month. Your average tax rate is 27.8% and your marginal tax rate is 41.1%.

Will I pay more taxes in 2021?

The big tax deadline for all federal tax returns and payments is April 18, 2022. The standard deduction for 2021 increased to $12,550 for single filers and $25,100 for married couples filing jointly. Income tax brackets increased in 2021 to account for inflation.

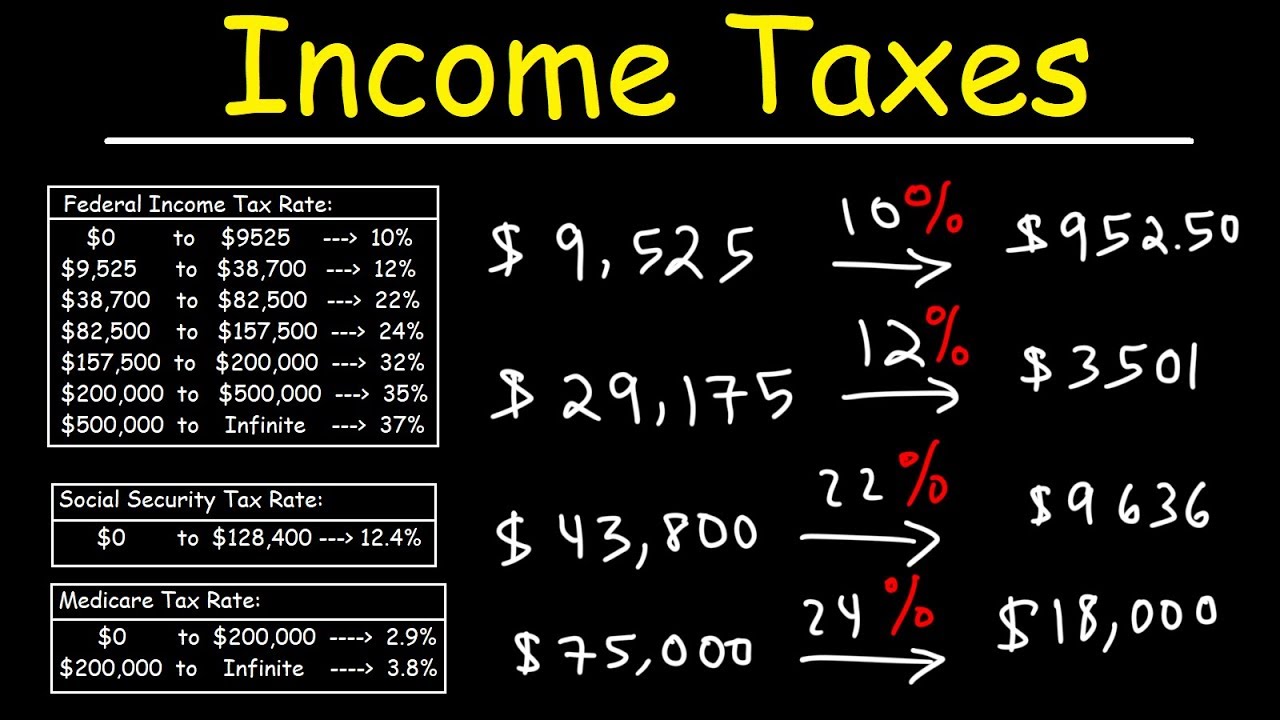

Calculating Federal Income Tax Withholding

Images related to the topicCalculating Federal Income Tax Withholding

Is it better to claim 1 or 0 on your taxes?

By placing a “0” on line 5, you are indicating that you want the most amount of tax taken out of your pay each pay period. If you wish to claim 1 for yourself instead, then less tax is taken out of your pay each pay period. 2.

How many federal allowances should I claim?

You can claim anywhere between 0 and 3 allowances on the 2019 W4 IRS form, depending on what you’re eligible for. Generally, the more allowances you claim, the less tax will be withheld from each paycheck. The fewer allowances claimed, the larger withholding amount, which may result in a refund.

Related searches

- $91,000 tax bracket

- federal income tax calculator

- how much federal tax should i pay on $7200

- how much federal tax should i pay on 4000

- how much federal tax should i pay on 20000

- taxes on $91,000 salary

- $91,000 a year is how much after taxes

- how much federal tax should i pay on $40 000

- 91k salary

- federal tax on $91,000

- taxes on 91000 salary

- federal tax on 91000

- how much federal tax should i pay on $19 000

- 91000 tax bracket

- how much federal tax should i pay on 81000

- how much federal tax should i pay on 50000

- how much federal tax should i pay on $99 000

- how much federal tax should i pay on 1500

- how much federal tax should i pay on 91000

- $91,000 a year after taxes

- how much federal tax should i pay on 97000

- 91000 a year is how much after taxes

- 91000 a year after taxes

Information related to the topic how much federal tax should i pay on 91000

Here are the search results of the thread how much federal tax should i pay on 91000 from Bing. You can read more if you want.

You have just come across an article on the topic how much federal tax should i pay on 91000. If you found this article useful, please share it. Thank you very much.