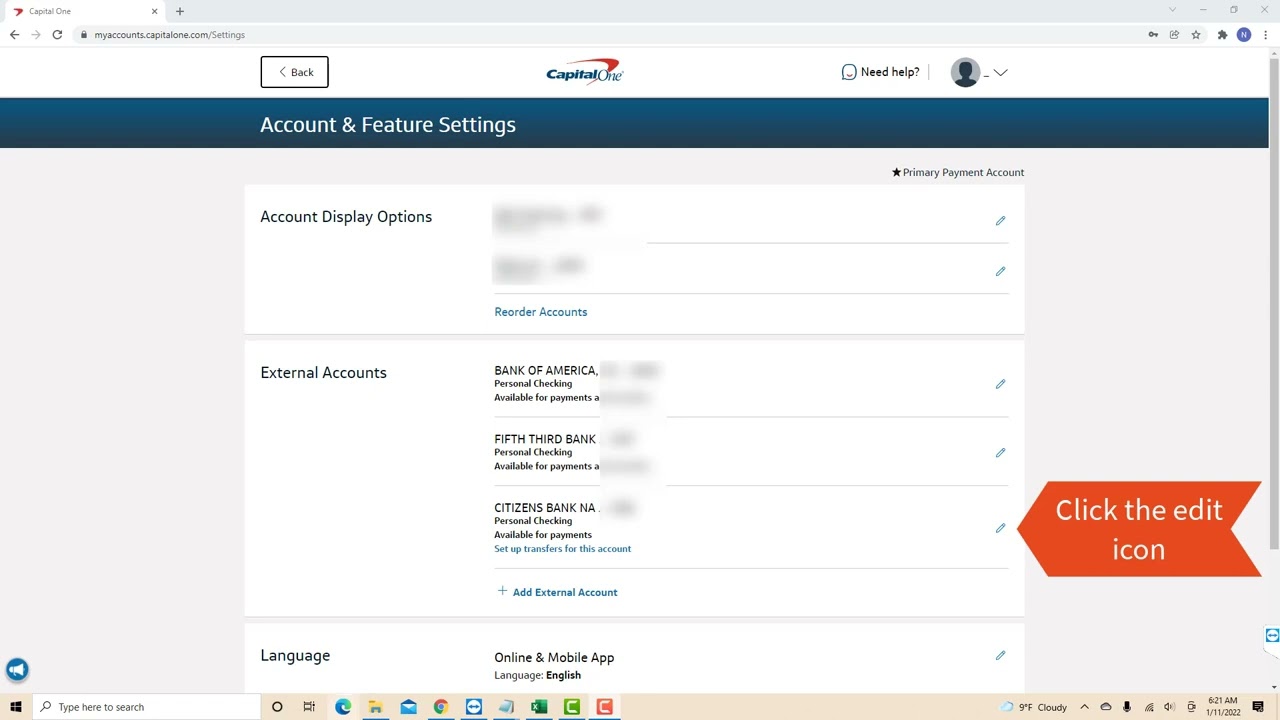

Let’s discuss the question: how to delete bank account from capital one app. We summarize all relevant answers in section Q&A of website Countrymusicstop in category: Technology. See more related questions in the comments below.

How do I delete an account on Capital One app?

There are two ways to delete your account on the Capital One app. You can go into the profile settings and then click on “delete my account” . Or you can go to Settings, then Account Settings, then select “Delete Account.

How do I remove an account from online banking?

How do I remove accounts from Online Banking? Click or tap the account you want to hide. Under details click or tap on Visibility. A pop-up screen will ask to confirm this action, click Yes, Hide.

How do I delete a savings account on Capital One?

You can close the account online by signing in to capitalone360.com, clicking on the account you want to close, and then selecting “Close your account” from the “Account details” tab. 29 thg 5, 2019

Does Capital One do pay to delete?

Make a Pay-For-Delete Agreement If you are unable to make a goodwill agreement with Capital One, you will need to work out a pay-for-delete agreement with them. This method will also work if Capital One has handed off the debt to a collection agency. 24 thg 3, 2021

How do I change bank accounts?

How To Switch Banks: A Step-By-Step Guide Finding a Bank. … Make a List of Your Automatic Payments and Deposits. … Open a New Bank Account. … Enroll in Online and Mobile Banking. … Update Your Automatic Payments and Deposits. … Close Your Old Bank Account. 7 thg 3, 2022

How do I delete my UPI ID from my bank account?

You need to login to your Paytm account and then go to Profile > Settings > UPI ID. Click on Delete UPI ID and confirm the deletion.

How can I delete my Metrobank mobile banking account?

When you click on the ‘Manage Accounts’ tab, a new web page will open where you will see an ‘Unenroll Accounts’ button. Click on this button. You will be redirected to another web page that will have a list of your accounts. Check the box in front of the account that you want to deactivate. 3 thg 7, 2017

How do I delete a bank account from QuickBooks online?

On a web browser Select the profile ⚙ icon and then Bank Accounts. Find the account you want to delete. Select the trash icon in that section. Type “DELETE” and select Delete to confirm. 23 thg 4, 2021

How do I unlink a bank account in QuickBooks?

How can I unlink my bank account from my QuickBooks account? On the left navigation bar, hover your cursor to Banking menu or Transactions menu and choose Banking. Select your bank account. Click the pencil ✎ icon, then press Edit account info. Put a checkmark on the Disconnect this account on save checkbox. Mục khác… • 7 thg 11, 2021

Does closing a bank account hurt your credit?

The good news is that, unlike closing a credit card account, closing a bank account generally won’t hurt your credit score. 23 thg 10, 2020

How do I close my Capital One joint bank account?

4 Ways to Close Your Capital One Bank Account By Phone. You can call the Customer Service of the bank to ask for account closure. … In-Person. If possible, you can also visit one of the physical banks in your state. … Online. … By Mail. … Open an Account at a New Bank. … Reset Automatic Payments. … Contact the Bank. … Celebrate. 15 thg 2, 2022

Will Capital One approve me again?

There’s one Capital One application rule that applies to all its credit cards: You can’t make more than one application every six months. After you apply for a Capital One card, you need to wait at least six months before applying for another, regardless of whether Capital One approved you or not. 19 thg 1, 2021

Can I change my bank account number?

Even under these circumstances, however, your bank won’t allow you to simply change your account number. Regardless of the reason for wanting to change account numbers, you’ll always need to close the bank account and open up a new one.

How many bank accounts can you have?

There’s no limit on the number of checking accounts you can open, whether you have them at traditional banks, credit unions or online banks. There is, however, a limit on how much of the money you keep in your checking account is FDIC insured. 7 thg 9, 2021

Is it bad to change banks?

It’s an inconvenience to be sure, but it can improve your financial situation, and if you’re moving, it’s often a necessary evil. No matter what your reason for switching, changing banks gives you the opportunity to secure lower fees, higher interest rates and better customer service.

How can I delete my Bhim account permanently?

Open BHIM App & Log In Your Account. First Of All, You Download The BHIM App On Your Mobile Phone And Log In To Your BHIM Account. … Click On The UP Right Side 3 Lines . … Now Go To Setting Menu. … Click On DEREGISTER Button. … Enter Your Default Bank Account Number. … Tap On Proceed Button To Delete Your BHIM Account.

Can I cancel my UPI ID?

You can ask your bank to deactivate the UPI facility from your account. You can do it by going to your bank’s home branch. Thus to close the UPI service on your linked bank account, go to the home branch of your bank. Then make a request there to deactivate the UPI service from your account permanently. 12 thg 2, 2020

How long before Metrobank account closed?

CLOSING OF ACCOUNTS Furthermore, the Bank shall impose an Early Closure Fee in the event that the account is closed within 30 days from the date of account opening.

What is 13 digit account number in Metrobank?

The Metrobank account number is a unique 13-digit number that is associated with a Metrobank deposit or savings account. The bank account number is needed to transfer or deposit money to a specific bank account, along with the name of the account holder, and in the case of international wire transfer, the SWIFT code. 12 thg 8, 2021

Can I close my account at any branch?

You cannot close your bank account online. You need to visit your home branch where you opened the account. So you need to walk into the home branch where you have an account and request them for account closure. 20 thg 1, 2020

Can we delete bank account?

Yes, you can. However, there are a few points you need to keep in mind before deleting a bank account. You must Uncategorise and Unmatch all the Categorised & Matched transactions. Use Exclude option to remove all the other transactions, associated with the bank.

Can I delete a bank account?

Inactive bank accounts You cannot delete a bank account after you have used it to process transactions. You can set a bank account to inactive and hide it from your banking list instead.

How do I logout of UBA mobile app?

iPhone/Android Mobile App steps: Select the Menu icon in the upper left of the account dashboard to access the menu. Scroll down and select Log out at the bottom of the menu. 15 thg 12, 2020

How do I delink a bank account in QuickBooks online?

Disconnect an account connected to online banking Go to the Banking menu or Transactions menu. Then select the Banking tab. Select the tile for the bank account. Select the pencil ✎ icon, then select Edit account info. Select the Disconnect this account on save checkbox. … Select Save and Close.

What happens if I delete a bank account in QuickBooks?

When you delete an account from QBO: The account will be made inactive in QBO. If the account has a non-zero balance, QBO will make an adjusting transaction. Although you can make a deleted account active again, you may need to make corrections to journal entries and balances. 25 thg 10, 2018

Can you turn off the Banking option in QuickBooks online?

Deactivate Bank Feeds for an account From the Lists menu, select Chart of Accounts. Right-click the account that needs to be deactivated then click Edit Account. Go to the Bank Feed Settings tab. Click Deactivate all online services.

Should I close bank accounts I don’t use?

Closing an account may save you money in annual fees, or reduce the risk of fraud on those accounts, but closing the wrong accounts could actually harm your credit score. Check your credit reports online to see your account status before you close accounts to help your credit score.

What happens if I stop using my bank account?

According to the RBI’s norm, if a customer discontinues using his or her account for 12 consecutive months then banks will automatically make then inactive, and more than extra inactive 12 months will make it a dormant account. 13 thg 9, 2019

What happens if you don’t close a bank account?

In a process what is called “escheating” an account, banks are required to turn over funds from the inactive account to the state treasury. Once the account is sent to the state, the funds are held as unclaimed property. 3 thg 2, 2022

Is Capital One a good bank?

Overall bank rating Capital One stands out with one of the best combinations of online bank perks — no checking or savings fees, a competitive savings rate and high CD rates — and a brick-and-mortar presence. It offers a top-of-the-line bank experience with strong customer support and doesn’t charge any overdraft fees.

How do I close my credit one account?

Over the phone: To cancel your card over the phone, call (877) 825-3242. When prompted, enter your card number. Once connected to a customer service representative, state that you want to cancel the card and close your account.

What is an excellent credit score?

670 to 739 Although ranges vary depending on the credit scoring model, generally credit scores from 580 to 669 are considered fair; 670 to 739 are considered good; 740 to 799 are considered very good; and 800 and up are considered excellent.

Is 7 credit cards too many?

As with almost every question about credit reports and credit scores, the answer depends on your unique credit history and the scoring system your lender is using. “Too many” credit cards for someone else might not be too many for you. There is no specific number of credit cards considered right for all consumers. 14 thg 2, 2020

Does Capital One run credit for credit increase?

No, Capital One does not do a hard pull for credit limit increases. They will conduct a soft pull on your credit report, which does not hurt your score. So, you can make a request anytime you want, but it is good to wait a few months after your account opening. 14 thg 12, 2021

Can I change my bank number online?

A Retail Internet Banking customer (Resident customer) having active ATM cum Debit card which account is mapped with internet banking username, can change his/her mobile number online without visiting branch.

Can my bank account be hacked with account number and routing number?

The Difference Between Routing Number and Account Numbers While someone cannot hack your account directly using only your bank’s routing number, a carelessly disposed physical check can compromise your bank account because personal checks contain both your routing and account number.

Can I change my bank account number and routing number?

Unfortunately, you can’t change the account number for your bank, as that number tells payers and payees where to withdraw or deposit money in your name. But if your account has been compromised, you can open a new bank account. 28 thg 2, 2022

Can banks see your other bank accounts?

Yes, a mortgage lender will look at any depository accounts on your bank statements — including checking accounts, savings accounts, and any open lines of credit. 18 thg 2, 2022

Can I open two bank accounts with same phone number?

yes. there is no hard and fast rule that one mobile number cannot be used for more than one account. if you have different accounts in different banks then you can register the same mobile number for all.

Can you have 2 bank accounts with the same bank?

You can open multiple savings accounts at the same bank or at several different banks. There are many reasons having multiple accounts can be useful, and it doesn’t impact your credit, so there’s little reason not to open extra savings accounts if you find it helpful to do so. 28 thg 9, 2020

Who is the number 1 bank in Canada?

Royal Bank of Canada 1. Royal Bank of Canada. The Royal Bank of Canada is the largest of the Big Five with respect to net revenue (C$11.4 billion in 2020) and capitalization (C$132.5 billion in 2020).

How often can I switch bank accounts?

The Financial Conduct Authority says there’s no limit to how often you can switch accounts. But switching accounts goes on your credit file and only keeping your bank account for a short period could have an impact on your credit score. 24 thg 10, 2019

How hard is it to change bank accounts?

How easy is it to switch bank accounts? Switching bank accounts is easy, but it does take several steps and requires coordinating your new and old accounts with all of your incoming and outgoing money. If you miss any steps in the process, you could overdraw one of your accounts or bounce a transaction.

How do I remove a bank account from my phone?

To unlink your bank account, Tap your profile picture on the PhonePe app home screen. Select the bank account under the Payment Methods section by scrolling to your right. You can also tap View all Payment Methods to view the bank accounts you’ve linked on PhonePe. Tap Unlink Bank Account.

How can I delete my bank account from Airtel thanks app?

You can edit bank account information by clicking the pencil icon. This takes you to the Edit Bank Account page. You can remove the bank account by clicking the garbage icon at the end of the line. To create a new bank account, click Add New.

How can I remove UPI ID from my bank account?

Call your bank helpline to get your phone number blocked from your account and ask to disable UPI service. File a first information report (FIR) about losing your mobile phone. This can be easily done online for residents of most states in India. 18 thg 7, 2021

How do I delete my UPI pin?

Reset your UPI PIN Open Google Pay . At the top right, tap your photo. Tap Bank account. Tap the bank account you want to edit. Tap Forgot UPI PIN. Enter the last 6 digits of your debit card number, and the expiry date. Create a new UPI PIN. Enter the OTP you get by SMS.

What is the full form of UPI?

Unified Payments Interface (UPI) is a system that powers multiple bank accounts into a single mobile application (of any participating bank), merging several banking features, seamless fund routing & merchant payments into one hood.

How can I delete my Metrobank app?

Choose “Contact for deletion” Click “Delete Account” and “Yes” Contact will be un-enrolled. … How do I delete accounts and credit cards? Go to Deposits or Credit Cards menu. Select account to delete. Click on the Trash Bin. Confirm account deletion.

How can I delete my Metrobank mobile banking?

When you click on the ‘Manage Accounts’ tab, a new web page will open where you will see an ‘Unenroll Accounts’ button. Click on this button. You will be redirected to another web page that will have a list of your accounts. Check the box in front of the account that you want to deactivate. 3 thg 7, 2017

Can I reopen my Metrobank account?

Payroll account deactivation and reactivation Metrobank may deactivate payroll accounts that show no payroll credit or other transactions, besides interest payments, for 90 consecutive days, without prior notice. Deactivated payroll accounts can be reactivated at their branch of account. 25 thg 6, 2021

How can I know my Metrobank 2021 account number?

In Summary: Check your ATM card information. Your account number should be below the account holder’s name. Visit any Metrobank branch to request for this information over the counter. … Call the Metrobank Customer Care hotline and request assistance for the retrieval of your account number.

Which bank account number is 13 digits?

Canara bank follows 4+3+6 format for the 13-digit account number. 9 thg 8, 2021

Is Metrobank and Metropolitan bank the same?

Metropolitan Bank and Trust Co. The Metropolitan Bank and Trust Company (PSE: MBT), commonly known as Metrobank, is the second largest bank in the Philippines. It offers various financial services, from regular banking to insurance.

How do I close my Capital One 360 account online?

You can close the account online by signing in to capitalone360.com, clicking on the account you want to close, and then selecting “Close your account” from the “Account details” tab. 29 thg 5, 2019

How do I close a bank account without visiting the branch?

Sadly, it is impossible to close an SBI bank account online or without visiting the bank branch. Therefore, the only step you can do while sitting at home to close your bank account is to download the SBI account closure form. 21 thg 8, 2021

How long does it take to close a bank account?

Closing a bank account is a straightforward process, but it can take an unexpectedly long time if you aren’t prepared. Depending on a few different factors, the process can take a day, a week, or even a few months. In most cases, closing a bank account can be finalized in one or two days. 28 thg 7, 2020

How do I delete my bank account history?

Remove the cleared status From Banking, open the relevant bank account. From Activity tab, select the tick box to the left the transactions you want to delete. A toolbar now appears above the list. On the toolbar, choose More then Remove Cleared Status.

How do I change bank accounts?

How To Switch Banks: A Step-By-Step Guide Finding a Bank. … Make a List of Your Automatic Payments and Deposits. … Open a New Bank Account. … Enroll in Online and Mobile Banking. … Update Your Automatic Payments and Deposits. … Close Your Old Bank Account. 7 thg 3, 2022

How do I change my bank account online?

EPF/ UAN Portal: How To Update Bank Account Number Online Step 1 – Login into UAN Portal. Step 2 – Go to KYC Section. Step 3- Choose Bank Account Update. Step 4- Enter New Bank Account Detail. Step 5– Authenticate yourself by Entering Aadhaar OTP. Step 6– Approvel by the Bank. Step 7- New Bank Account Number Updation. 24 thg 6, 2021

How can I change my UBA bank account number?

If you want to change your UBA alert number in Nigeria, visit the nearest UBA branch and request an account update. Fill the UBA bank account update form and enter the new number you would like to use as an alert number. 7 thg 1, 2022

How can I delete my old mobile banking in BDO?

Once logged in, you will be required to perform the following additional steps: Go to “Enrollment Services”. Choose Mobile Device(s). Choose View / Delete Mobile Device(s). Choose the device that will be deleted. Click on the “Delete” or “X” button. Provide answer to the “Challenge Question”. Mục khác…

Can you delete a bank account online?

You cannot remove or delete an FSB account from online banking, but you may hide that account from displaying.

Can I remove an account from online banking?

Yes, you can. There are, however, a few things to consider before removing a bank account. To get rid of all the other transactions linked to the bank, use the Exclude option.

Can you delete bank account?

Now it’s time to go ahead and cancel your bank account. Many banks allow you to do this online, but it also could require a phone call to customer service or a visit to your local bank branch. Some banks may require you to fill out an account closure request form or submit a written request. 13 thg 1, 2021

How do I delete a bank account in QuickBooks app?

Delete your bank accounts and transactions Select the profile ⚙ icon and then Bank Accounts. Find the account you want to delete. Select the trash icon in that section. Type “DELETE” and select Delete to confirm. 23 thg 4, 2021

How do I delete a bank feed?

In the Accounting menu, select Bank accounts. Next to the account that has the feed you want to stop, click Manage Account. Under Bank Feeds, click Deactivate feed or Disconnect feed.

How do you remove a bank feed?

Once done, proceed with the steps below. Go to Lists from the top menu. Select Chart of Accounts. Locate and right-click the account. Choose Edit Account. Go to the Bank Feed Settings tab. Select Deactivate All Online Services. Click Save & Close. Hit OK to confirm. 27 thg 2, 2020

How do I hide bank transactions from my parents?

If you really need to hide a purchase, such as when buying a gift or something highly personal, you do have a few options: Use cash. Cash is a reliable low-profile way of making purchases. … Buy and use a gift card. … Use an online payment service. … Switch to electronic payments. 4 thg 1, 2021

Does Capital One still have purchase eraser?

The Capital One Purchase Eraser is a tool that lets you “erase” travel purchases made within the last 90 days by using your earned miles. Purchase Eraser is available on Capital One’s travel rewards cards: Capital One Venture Rewards Credit Card. 3 thg 9, 2019

Can you close a bank account anytime?

Most of the time, yes, but your bank or credit union may require you to settle your balance before allowing you to close an account that is overdrawn. 28 thg 8, 2020

Will it affect my credit score if I close my bank account?

Your credit score is calculated based only on information included in your credit report, and your bank details aren’t reported to the credit bureaus. While closing a savings or checking account won’t affect your credit score, closing a credit card account can.

Is it necessary to close bank account?

Because you have to maintain minimum balance requirements on each of them. So it is advisable to close bank accounts that are not used actively. If you among them who have an unwanted bank account then you should close it. 20 thg 1, 2020

Will a bank account automatically close if it reaches zero balance?

Any Account with zero balance, regardless of status, may automatically be closed by the Bank without notice.

How do I know if my bank account is active?

You can check if your old bank account is active. … Gather Bank Documentation Emails and text messages from your bank. Canceled checks and bank statements (online and physical copies) Old checkbooks may have deposit slips or carbon copies of checks printed with account numbers. Old passbooks for savings accounts. Mục khác… • 20 thg 7, 2021

Is Capital One app safe?

Capital One mobile app security Digital security is the highest priority for any financial app, and the Capital One mobile app’s security features can be accessed through the Profile screen. Here, you can edit your username or change your password. 24 thg 8, 2021

Is Capital One a safe bank?

Is Capital One Bank safe? Capital One employs several security measures to ensure the safety of customer accounts and personal information. These include SSL encryption, fraud protection, debit card locking features and more. Capital One did have a security breach in 2019 involving credit card accounts. 21 thg 2, 2021

Is Capital One a good credit card?

The Capital One Platinum Credit Card is a solid option for those with average credit. It has an annual fee of $0 and also charges no foreign transaction fees. But for many, its standout feature may be that it also offers the chance to earn a higher credit limit after making on-time payments in as little as six months.

How do I know if my Credit One account is closed?

You can call customer service at (877) 825-3242 to try to find out specifically why Credit One closed the account. But Credit One typically does not re-open closed accounts, nor are they under any obligation to do so. 12 thg 5, 2021

Is paying off a car good for credit?

In some cases, paying off your car loan early can negatively affect your credit score. Paying off your car loan early can hurt your credit because open positive accounts have a greater impact on your credit score than closed accounts—but there are other factors to consider too. 20 thg 7, 2019

Is it better to have a 0 balance on your credit card?

“Having a zero balance helps to lower your overall utilization rate; however, if you leave a card with a zero balance for too long, the issuer may close your account, which would negatively affect your score by reducing your average age of accounts.” 19 thg 10, 2020

What is an excellent credit score?

670 to 739 Although ranges vary depending on the credit scoring model, generally credit scores from 580 to 669 are considered fair; 670 to 739 are considered good; 740 to 799 are considered very good; and 800 and up are considered excellent.

Can I have 10 credit cards?

While I’m nowhere near extreme credit card optimizers who have over 30 credit cards, 10 cards is still well above the national average of four. There’s no perfect answer to how many credit cards should you have, as long as you’re responsible about paying off your balance on time and in full each month.

What happens if I go over my credit limit but pay it off?

Increased interest rate: If you go over your credit limit, the card issuer could begin charging you a much higher annual percentage rate (APR), called a penalty APR or default APR. This higher interest rate will make repaying the debt more difficult because more of your payment will go toward interest. 31 thg 7, 2020

How can I raise my credit limit without asking?

How to get a credit limit increase without asking: Always pay all your bills on time. Pay off the card you want the higher limit on fully each month. Update your income on the credit card company’s website/app. Keep your account open for at least 6-12 months.

How can I know my bank account number with mobile number?

Use a mobile banking website or app to find the number online. Navigate to your bank’s website on a computer or open up their mobile app on your phone or tablet. Sign in and click on the tab to view a summary of your account. Usually, the account number will be listed on this page.

How do you check how many bank accounts are linked with my mobile number?

Follow the steps mentioned below: Step 1: Dial *99*99*1# with your mobile number registered with UIDAI. Step 2: Now enter your 12 digit Aadhaar number. Step 3: Re-enter the Aadhaar number and click on “Send” Step 1: Login to the mAadhaar app. Step 2: Click on ‘My Aadhaar’ and select ‘Aadhaar-Bank Acc Link Status’ Mục khác… • 23 thg 3, 2022

How can someone withdraw money from an ATM without my card?

Bank of America, Chase and Wells Fargo are just a few banks that offer cardless or “tap” ATM access. … Some simple ways to withdraw money without a debit card include the following: Cash a check at your bank. … Cash a check at a store. … Use a withdrawal slip at a bank branch. … Work with a bank teller. 16 thg 10, 2021

Is it safe to give account number and routing number?

But like any other financial information, it’s important to keep your details safe. Someone could, for example, use your bank routing number and checking account number to order fraudulent checks. Or they may be able to initiate a fraudulent ACH withdrawal of money from your account. 4 thg 6, 2021

Can you change a bank account number?

Even under these circumstances, however, your bank won’t allow you to simply change your account number. Regardless of the reason for wanting to change account numbers, you’ll always need to close the bank account and open up a new one.

Can I change my bank number online?

A Retail Internet Banking customer (Resident customer) having active ATM cum Debit card which account is mapped with internet banking username, can change his/her mobile number online without visiting branch.

Can someone check my bank account balance?

The bank teller helping you at the bank can see your bank account balance when he or she is helping you with your banking needs. This is true when you are making a deposit and request your balance, or are withdrawing money and request a receipt for the transaction.

Can I have two banks?

Is there a limit to how many bank accounts I can open? No, technically you can open as many bank accounts as you want, providing you meet the bank’s requirements. 13 thg 7, 2021

How many bank accounts can a person have with one phone number?

You can add two or more bank account in Google Pay when your bank registered mobile number is the same. If the registered mobile number is different in both bank accounts then you cannot add both accounts in Google Pay. 10 thg 8, 2020

What is the maximum number of accounts that one person can open at the same bank and branch?

There is no rule to cap the number of bank accounts which can be possibly open in one bank or a combination of banks. 5 thg 9, 2019

Can banks see your other bank accounts?

Yes, a mortgage lender will look at any depository accounts on your bank statements — including checking accounts, savings accounts, and any open lines of credit. 18 thg 2, 2022

Do millionaires have bank accounts?

Millionaires also have zero-balance accounts with private banks. They leave their money in cash and cash equivalents, and they write checks on their zero-balance account.

What is the safest bank in Canada?

Canada has one of the safest banking systems in the world. The Royal Bank of Canada, TD Bank, Bank of Nova Scotia (Scotiabank), Bank of Montreal, and the Canadian Imperial Bank of Commerce all rank within the top-35 most stable banks in the world. 1 thg 3, 2022

Can Canadian banks fail?

Although bank failures are rare in Canada, CDIC is there to protect deposits at its member institutions, big or small. In the case of larger members, CDIC has plans to ensure that all of us would have ongoing access to our deposits and day-to-day banking services. But some things are not protected by CDIC.

How do I change bank accounts?

How To Switch Banks: A Step-By-Step Guide Finding a Bank. … Make a List of Your Automatic Payments and Deposits. … Open a New Bank Account. … Enroll in Online and Mobile Banking. … Update Your Automatic Payments and Deposits. … Close Your Old Bank Account. 7 thg 3, 2022

Can I have 2 current account?

You can’t have more than one current account In a word – false. You can have as many current accounts across as many different financial institutions as you like. There could also be benefits to having more than one bank account. 1 thg 9, 2021

What happens when you switch banks?

If anything goes wrong with the switch, your new bank will refund any interest (paid or lost) and charges made on either your old or new current accounts as a result of this failure. You’ll have to ask your new provider for this, though. The service is free to use and you can choose and agree your switch date. 16 thg 9, 2013

How often can I switch bank accounts?

The Financial Conduct Authority says there’s no limit to how often you can switch accounts. But switching accounts goes on your credit file and only keeping your bank account for a short period could have an impact on your credit score. 24 thg 10, 2019

How do I delete my UPI account?

To delete an account: Select UPI settings in ‘My Account’ section. Select UPI linked bank accounts option. Click on the three dots and select the option to delete bank account. Select the accounts to delete and click delete account.

How do I delete my UPI ID?

You need to login to your Paytm account and then go to Profile > Settings > UPI ID. Click on Delete UPI ID and confirm the deletion.

How can I delete my Airtel bank account?

Step 1: For closing an Airtel Payment Bank account, write to the email address mentioned below: [email protected]. Step 2: A representative will write back and ask for confirmation, you’ll need to provide proof of your address and identification, and you can also email your Aadhar number. 1 thg 11, 2021

How can I deactivate Airtel wallet?

You can contact us at [email protected] and provide your email id and mobile number or call us from your registered mobile number at Airtel customers dial in 400 and Non Airtel customers dial in 8800688006. Your wallet will be blocked and balance amount will be refunded back to you.

How do I delete a bank account from my bank?

Delete a bank account Go to Banking, then click Delete under the account name. When prompted, click OK to confirm the deletion.

How can I delete my bank account from BHIM?

Login to BHIM App > Bank Account. You will then be shown the bank accounts that you’ve linked to your BHIM account. You can select the ‘Remove’ option under the account that you would like to remove/delete/unlink from your BHIM account.

How do I remove a bank account from my phone?

To unlink your bank account, Tap your profile picture on the PhonePe app home screen. Select the bank account under the Payment Methods section by scrolling to your right. You can also tap View all Payment Methods to view the bank accounts you’ve linked on PhonePe. Tap Unlink Bank Account.

Can UPI be hacked?

Even though UPI has a huge impact on the digital economy, it comes with considerable security risks. A significant rise in UPI transactions has led to increasing online financial attacks, UPI fraud complaints, hacking, cyber-frauds, and other associated risks. 23 thg 3, 2021

Is Google Pay is UPI?

In relation to UPI Payment Transactions, Google Pay is a TPAP authorised by NPCI to facilitate Payment Transactions through HDFC Bank, Axis Bank, ICICI Bank and State Bank of India. We are a service provider and participate in UPI through PSP Banks. 18 thg 11, 2021

Is UPI an Indian?

Unified Payments Interface (UPI) is an instant real-time payment system developed by National Payments Corporation of India (NPCI) facilitating inter-bank peer-to-peer (P2P) and person-to-merchant (P2M) transactions.

How do I remove an account from online banking?

How do I remove accounts from Online Banking? Click or tap the account you want to hide. Under details click or tap on Visibility. A pop-up screen will ask to confirm this action, click Yes, Hide.

How long before Metrobank account closed?

CLOSING OF ACCOUNTS Furthermore, the Bank shall impose an Early Closure Fee in the event that the account is closed within 30 days from the date of account opening.

Can I delete my Metrobank online account?

When you click on the ‘Manage Accounts’ tab, a new web page will open where you will see an ‘Unenroll Accounts’ button. Click on this button. You will be redirected to another web page that will have a list of your accounts. Check the box in front of the account that you want to deactivate. 3 thg 7, 2017

Is Metrobank and Metropolitan bank the same?

Metropolitan Bank and Trust Co. The Metropolitan Bank and Trust Company (PSE: MBT), commonly known as Metrobank, is the second largest bank in the Philippines. It offers various financial services, from regular banking to insurance.

How can I delete my Metrobank app?

Choose “Contact for deletion” Click “Delete Account” and “Yes” Contact will be un-enrolled. … How do I delete accounts and credit cards? Go to Deposits or Credit Cards menu. Select account to delete. Click on the Trash Bin. Confirm account deletion.

How can I activate my inactive Metrobank account?

To reactivate your dormant account, visit your home branch and provide a written request for reactivation of your account. Your bank may ask you for fresh KYC documentation and hence, carry along with you an identity proof, address proof and recent photograph. 29 thg 8, 2016

What is my 13 digit account number Metrobank?

In Summary: Check your ATM card information. Your account number should be below the account holder’s name. Visit any Metrobank branch to request for this information over the counter. … Call the Metrobank Customer Care hotline and request assistance for the retrieval of your account number.

What is 13 digit account number in Metrobank?

Metrobank: Metrobank accounts are usually 13-digits long (eg. 0123456789010). However, if your recipient only has a 10 digit number, take the 2nd, 3rd, & 4th digits (eg. 0123456789) and input them at the front of the account number.

Which bank has 14 digits account number?

HDFC Bank account number is made up of 14 digits.

Can a bank account number be 16 digits?

A primary account number is a 14, 15, or 16 digit number generated as a unique identifier for a primary account. Primary account numbers are issued to payment cards such as credit and debit cards as well as other cards that store value like a gift card.

Who owns Metropolitan Bank?

Who owns Metrobank. As of December 2021, 48.2% of the company is publicly owned, where 37.2% belong to GT Capital Holdings, Inc., and 14.6% to the Ty family and other related parties. Metrobank (MBT) has been listed on the Philippine Stock Exchange since 1981.

What type of bank is PNB?

Philippine commercial bank Philippine National Bank (PSE: PNB), the country’s first universal bank, is the fourth largest privately-owned Philippine commercial bank. PNB was established by the Government of the Philippines in 1916 and became fully privatized in 2007.

Does closing a bank account hurt your credit?

The good news is that, unlike closing a credit card account, closing a bank account generally won’t hurt your credit score. 23 thg 10, 2020

What happens if you don’t close a bank account?

In a process what is called “escheating” an account, banks are required to turn over funds from the inactive account to the state treasury. Once the account is sent to the state, the funds are held as unclaimed property. 3 thg 2, 2022

Do banks charge for closing an account?

Most banks do not charge a fee to close a bank account. One caveat to this rule is that some banks will charge an early account closure fee if you close an account soon after opening it. For example, PNC charges a $25 fee if you close an account within 180 days of opening. 13 thg 1, 2021

Will a bank account automatically close if it reaches zero balance?

Any Account with zero balance, regardless of status, may automatically be closed by the Bank without notice.

Should I close a bank account I don’t use?

Closing an account may save you money in annual fees, or reduce the risk of fraud on those accounts, but closing the wrong accounts could actually harm your credit score. Check your credit reports online to see your account status before you close accounts to help your credit score.

Is it necessary to close bank account?

Because you have to maintain minimum balance requirements on each of them. So it is advisable to close bank accounts that are not used actively. If you among them who have an unwanted bank account then you should close it. 20 thg 1, 2020

How do I close a bank account without visiting the branch?

Sadly, it is impossible to close an SBI bank account online or without visiting the bank branch. Therefore, the only step you can do while sitting at home to close your bank account is to download the SBI account closure form. 21 thg 8, 2021

How do I hide bank transactions from my parents?

If you really need to hide a purchase, such as when buying a gift or something highly personal, you do have a few options: Use cash. Cash is a reliable low-profile way of making purchases. … Buy and use a gift card. … Use an online payment service. … Switch to electronic payments. 4 thg 1, 2021

How do I delete transactions on cash App?

Yes, you can delete transaction history on the Cash App. To do so, go to the Cash App and tap “More” in the top left corner of your screen. Select “Settings”, then tap “Privacy & Security” and scroll down to “Transaction History”. Underneath “Manage Your Account”, you’ll see a button that says “Remove All”.

Can I change my bank account number?

Even under these circumstances, however, your bank won’t allow you to simply change your account number. Regardless of the reason for wanting to change account numbers, you’ll always need to close the bank account and open up a new one.

How many bank accounts can you have?

There’s no limit on the number of checking accounts you can open, whether you have them at traditional banks, credit unions or online banks. There is, however, a limit on how much of the money you keep in your checking account is FDIC insured. 7 thg 9, 2021

Where is switch bank located?

Swiss Bank Corporation was a Swiss investment bank and financial services company located in Switzerland. … Swiss Bank Corporation. Type Acquired Defunct 1998 Fate Merged with Union Bank of Switzerland to form UBS Successor UBS Headquarters Basel, Switzerland 4 hàng khác

How can I update my bank account in EPF?

Step 1: Visit https://unifiedportal-mem.epfindia.gov.in/memberinterface/ to access your account. Step 2: Go to the Manage Tab and select the KYC option. Step 3: Select Bank as the document type. Enter, name as per bank records, and IFSC, enter the right bank account number. 15 thg 3, 2022

How can I change my bank account in EPF?

– Log on to EPFO’s member portal and sign in using your credentials. – Next, click on the ‘Manage’ tab on the top menu. – Go to the KYC option from the drop-down menu and select ‘bank’ in the document type. – Enter your updated bank details such as AC number and IFSC code before clicking on Save to proceed. 7 thg 11, 2021

How can I change my bank details in EPF offline?

How to update bank account details in UAN? Visit ‘Unified Member Portal’. Login with ‘UAN’ and ‘Password’. Click on ‘Manage’ tab. Select ‘KYC’ option from Drop Down Menu. Select ‘Documents’. Enter ‘bank account number and IFSC’. Click ‘Save’. 16 thg 7, 2021

How do you delete transaction history on UBA mobile app?

From Banking, select the relevant bank account. From the Activity tab, select the tick box to the left the transactions you want to delete. A toolbar now appears above the list. From the toolbar, select the Delete button.

What does cleared balance mean in UBA?

The cleared balance is the available, ‘true’ interest-bearing balance calculated for a particular day. It includes forward-value transactions from previous statements and GL sweeping/ topping transactions proposed that day.

How can I delete my BDO account online?

If you need to remove a device, please log in to your Digital Banking on your web browser and click Enrollment > Mobile Device(s) > View/Delete Mobile Device(s) and select the device you want to delete.

What is the difference between BDO digital banking and BDO online?

What is the difference between the old BDO Digital Banking app and the new BDO Online app? The old BDO Digital Banking app and the new BDO Online app are both used to access BDO’s online banking services. BDO Online is just the new and improved version of the BDO Digital Banking.

How do I close my BDO account?

All you have to do is to go to any BDO ATM branch and withdraw all your money and BDO will automatically close the savings account for you since there is no money left in your account and they see that it is inactive. You will not incur any penalties in doing so, since this is your own money.

How do I delete an account?

Remove a Google or other account from your phone Open your phone’s Settings app. Tap Passwords & accounts. … Under “Accounts for,” tap the account you want to remove. … To confirm, tap Remove account. … If this is the only Google Account on the phone, you’ll need to enter your phone’s pattern, PIN, or password for security.

Why is it so hard to delete accounts?

The harder it is to delete information, the less likely users are to do it. Countless new apps and online services are launched every day. Curiosity might compel us to try one out, but doing so will invariably require us to create an account. 24 thg 10, 2021

How do you delete an account you don’t use?

How to Delete Your Old Accounts Search for the name of the website or service and “delete account” using a web search engine like Google or DuckDuckGo. Check JustDelete.me, which offers a convenient database with instructions for deleting a wide variety of online accounts. Mục khác… • 3 thg 3, 2021

How do I delete a bank account from Quickbooks?

Delete your bank accounts and transactions Select the profile ⚙ icon and then Bank Accounts. Find the account you want to delete. Select the trash icon in that section. Type “DELETE” and select Delete to confirm. 23 thg 4, 2021

How can I delete my account in BDO Mobile banking?

Once logged in, you will be required to perform the following additional steps: Go to “Enrollment Services”. Choose Mobile Device(s). Choose View / Delete Mobile Device(s). Choose the device that will be deleted. Click on the “Delete” or “X” button. Provide answer to the “Challenge Question”. Mục khác…

Can I delete my bank account online?

You cannot remove or delete an FSB account from online banking, but you may hide that account from displaying.

How do I close my Capital One 360 account online?

You can close the account online by signing in to capitalone360.com, clicking on the account you want to close, and then selecting “Close your account” from the “Account details” tab. 29 thg 5, 2019

How do I close a bank account and transfer to another bank?

Switching Banks: Step By Step Step 1: Start A Relationship With A New Bank. Step 2: Reroute Auto Payments & Direct Deposits To Your New Account. … Step 3: Put Your Old Account Into Hibernation. … Step 4: Close Your Account Permanently. … Step 5: Get Confirmation In Writing. … Step 6: Review Your Final Bank Statement. 24 thg 7, 2015

Can we delete bank account?

Yes, you can. However, there are a few points you need to keep in mind before deleting a bank account. You must Uncategorise and Unmatch all the Categorised & Matched transactions. Use Exclude option to remove all the other transactions, associated with the bank.

Can I delete a bank account in QuickBooks online?

Go to Banking and then select the Banking tab. Choose the account you want to delete, and then click its Edit icon. Select Edit account info. In the Account window, select Disconnect this account on save. 12 thg 3, 2021

Can you hide bank transactions?

In the Bank Feeds window, right-click the transaction and choose Hide Transaction. The hidden transaction disappears from the Bank Feeds window. 7 thg 12, 2018

How do I cancel a bank link?

If you want to stop processing transactions for a bank account, and/or delete the bank account, you’ll need to generate a Send Delete Request from within BankLink Practice. This request will be emailed to MYOB Client Services. 11 thg 2, 2016

How do you delete a bank feed in QuickBooks online?

Here’s how: Go to the Banking menu. Then select the Banking tab. Tap the tile for the bank account. Click on the pencil ✎ icon, then select Edit account info. Press the Disconnect this account on save checkbox. Note: If QuickBooks is downloading new transactions, you won’t see this option. … Hit Save and Close. 6 thg 3, 2021

How do I delete a bank feed in QuickBooks online?

Step 2: Deactivate Bank Feeds Go to Lists and then select Chart of Accounts. Right-click the account you want to deactivate. Then select Edit Account. Go to the Bank Settings tab. Select Deactivate all online services and then OK to confirm. Select Save & Close.

How do I delete a bank statement?

Officially, you can’t delete a bank statement. Bank statements are technically legal documents. They can be subpoenaed in civil and criminal court proceedings, and for that reason, it’s illegal to delete them or tamper with them in any way. 10 thg 9, 2021

How do I use my Capital One eraser?

The two most valuable ways to redeem miles for travel are by: Using the Purchase Eraser to offset a previous travel purchase you made with your card. You start by logging in to the Capital One website or calling the issuer’s Rewards Center and requesting an account credit for a specific travel expense.

How do I use Capital One purchase eraser?

Here’s how the Capital One Purchase Eraser works: Click on your rewards miles, and then select the “Cover a Purchase” option. Your eligible travel purchases will show up, along with the number of miles required to pay for each in full. 13 thg 12, 2021

What is travel eraser?

If you have a Capital One travel rewards card, the Purchase Eraser feature can help you redeem points for past travel charges in just a few clicks. It works like a statement credit, but it’s limited to eligible travel purchases. 3 thg 9, 2019

How do I close my bank account on mobile?

Once your account balance is zero, call BankMobile® Customer Care at 1-877-EASY515 (327-9515) Monday through Friday 8:00 am to 11:00 pm EST and ask them to close your account.

How long does it take to close a bank account?

Closing a bank account is a straightforward process, but it can take an unexpectedly long time if you aren’t prepared. Depending on a few different factors, the process can take a day, a week, or even a few months. In most cases, closing a bank account can be finalized in one or two days. 28 thg 7, 2020

Can you close a bank account with a negative balance?

Can you close a bank account with a negative balance? No. If you request to close an overdrawn account, your bank will require you to pay the balance before they can close the account. Without that, banks will refuse to close the account. 28 thg 6, 2021

Is it better to close a credit card or leave it open with a zero balance?

The standard advice is to keep unused accounts with zero balances open. The reason is that closing the accounts reduces your available credit, which makes it appear that your utilization rate, or balance-to-limit ratio, has suddenly increased. 3 thg 4, 2019

Do bank accounts show up on credit reports?

While your credit report features plenty of financial information, it only includes financial information that’s related to debt. Loan and credit card accounts will show up, but savings or checking account balances, investments or records of purchase transactions will not. 10 thg 4, 2021

What will happen if you don’t close bank account?

An inoperative bank account entails a penalty, which depends on the concerned bank’s policy. The penalty holds true only during the period when the account is non-operational. This charge is levied on an annually and isn’t a lot. Also, customers are penalized if the minimum account balance is not maintained.

What happens if I stop using my bank account?

According to the RBI’s norm, if a customer discontinues using his or her account for 12 consecutive months then banks will automatically make then inactive, and more than extra inactive 12 months will make it a dormant account. 13 thg 9, 2019

Will a bank account automatically close if it reaches zero balance?

Any Account with zero balance, regardless of status, may automatically be closed by the Bank without notice.

How do you know that your bank account is active or not?

You should visit your nearest bank branch with your account number and they will tell you if your account is active or not.

What happens if your bank account hits 0?

When the primary account reaches zero, funds from the other account are used (transferred) to cover the amount. You will usually pay a small fee for the transfer. Ideally, your linked account would be a savings account or another checking account. 9 thg 4, 2021

Is it necessary to close bank account?

You don’t need a reason to close a bank account, however there are numerous reasons you might want to. Here are some of the more common reasons to move on from your current account: Moving to a new city or state. To get better interest rates. 13 thg 1, 2021

Is Capital One online safe?

Is Capital One Bank safe? Capital One employs several security measures to ensure the safety of customer accounts and personal information. These include SSL encryption, fraud protection, debit card locking features and more. Capital One did have a security breach in 2019 involving credit card accounts. 21 thg 2, 2021

Is Capital One a Visa or Mastercard?

Capital One issues Visa credit cards and Mastercard credit cards both. Unlike Capital One, which is a bank, Visa and Mastercard are card networks. 23 thg 1, 2021

Who is Capital One Bank owned by?

Who is the parent company of Capital One? Capital One’s parent company is Signet Financial Corp. On July 21, 1994, Richmond, Virginia-based Signet Financial Corp (presently some portion of Wells Fargo) declared the corporate side project of its Visa division, OakStone Financial, naming Richard Fairbank as CEO. 9 thg 11, 2020

What happened Capital One Bank?

Capital One temporarily closed all of its branches during the height of the coronavirus pandemic. The company has decided to reopen a few of its locations. Some consumers, however, have noticed the seemingly rapid closure of dozens of branches throughout the country. 19 thg 5, 2021

Is Capital One or Chase better?

When it comes to Chase vs. Capital One, both offer a range of rewards cards, as well as cards for people with average credit. Capital One tends to offer more options for people with lower credit scores, while Chase tends to offer more credit cards for people with excellent credit who want high-powered rewards.

Is Capital One a good bank?

Overall bank rating Capital One stands out with one of the best combinations of online bank perks — no checking or savings fees, a competitive savings rate and high CD rates — and a brick-and-mortar presence. It offers a top-of-the-line bank experience with strong customer support and doesn’t charge any overdraft fees.

Do Capital One increase your credit limit?

Increasing the credit limit on your Capital One credit card can be a great way to add more flexibility to your budget and possibly increase your score. Capital One does allow credit limit increases, but only to eligible cardholders. Luckily, even folks with an average credit score may qualify for a high credit limit. 14 thg 1, 2019

Is 7 credit cards too many?

As with almost every question about credit reports and credit scores, the answer depends on your unique credit history and the scoring system your lender is using. “Too many” credit cards for someone else might not be too many for you. There is no specific number of credit cards considered right for all consumers. 14 thg 2, 2020

Are Capital One and Credit One the same?

Is Credit One the same as Capital One? No. Credit One and Capital One are two distinct, independent companies. While they share some branding similarities and are both U.S.-based banks that issue credit cards, Credit One and Capital One have no direct affiliation. 16 thg 2, 2022

Does closing credit accounts hurt your credit score?

A credit card can be canceled without harming your credit score; just remember that paying down credit card balances first (not just the one you’re canceling) is key. Closing a charge card won’t affect your credit history (history is a factor in your overall credit score).

Can you reopen a closed Credit One account?

But Credit One typically does not re-open closed accounts, nor are they under any obligation to do so. Still, it doesn’t hurt to ask. By the way, if Credit One closes your account with an outstanding balance, including any unpaid annual fee, you’re still responsible for paying it off in full. 12 thg 5, 2021

Related searches

- how to hide accounts on capital one app

- how to delete bank account from capital one

- how to delete transaction history on capital one app

- how to cancel payment on capital one app

- capital one customer service

- how to delete payment account

- how to remove an account from the capital one app

- capital one 360

- how to remove my bank account from capital one app

- how to cancel autopay on capital one credit card

- capital one account

You have just come across an article on the topic how to delete bank account from capital one app. If you found this article useful, please share it. Thank you very much.